Fundamental Analysis And Intrinsic Value Avanti Feeds Ltd.

Dated: 24 Mar 23

Company: Avanti Feeds Ltd.

CMP: 360.30

Introduction

In this article we will try to analyze Avanti Feeds Ltd. Based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this analysis we will try to gain insight into the financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment.

Note: Here we are carrying out only the quantitative fundamental analysis of the company as the qualitative analysis is more subjective and individual views may vary vastly.

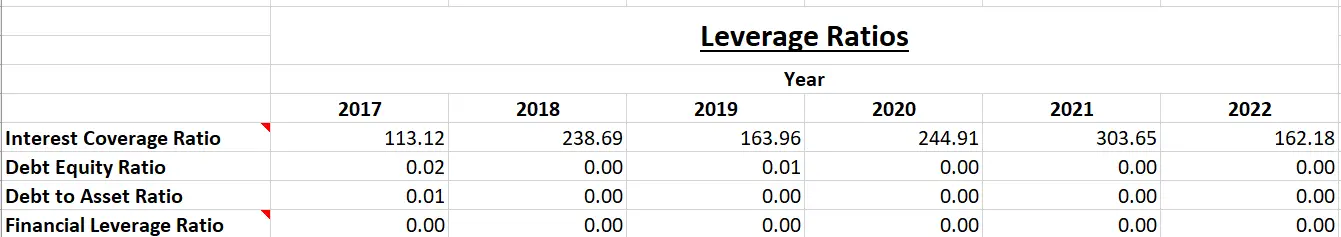

Leverage Ratios

Observations:

- The company is operating with almost no debt and that is a healthy sign for the financial health of the company.

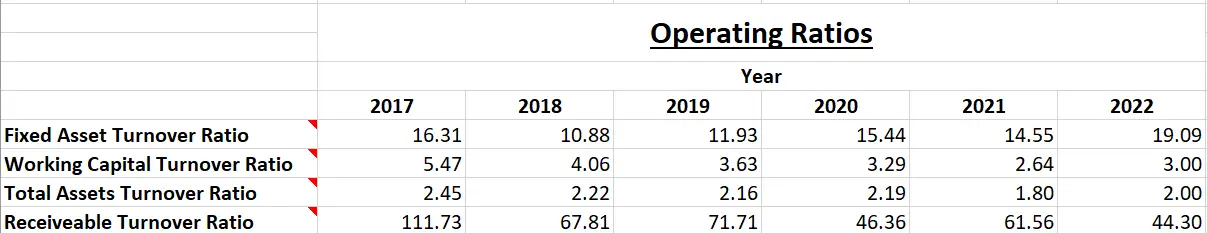

Operating Ratios

Observations:

- All ratios except the Fixed asset turnover ratio have shown a decreasing trend. This indicates the overall operating efficiency of the company is on a downward trend and the management has to take appropriate measures to address this issue.

- Receivables of the company has been increasing over the period of last five years and the company is facing difficulty in collecting its outstanding receivables.

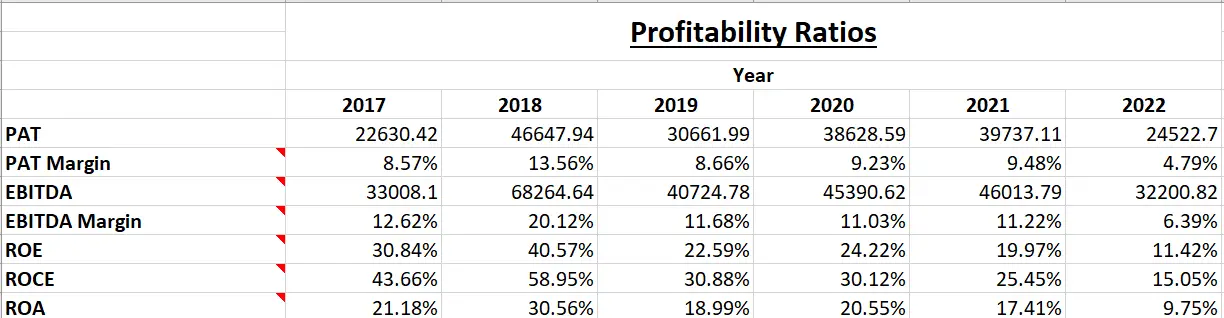

Profitability Ratios

Observations:

- PAT has been coming down very gradually at about Rs 78.67 Cr per year. The revenue of company has been increasing steadily all this while, indicating that the operational expenses have gone up considerably.

- The same is also visible in EBITDA and EBITDA Margins that have also been on a decline.

- All the profitability indicators have been on a decline since 2018 and have not shown any notable improvement since COVID.

Intrinsic Value

Assumptions:

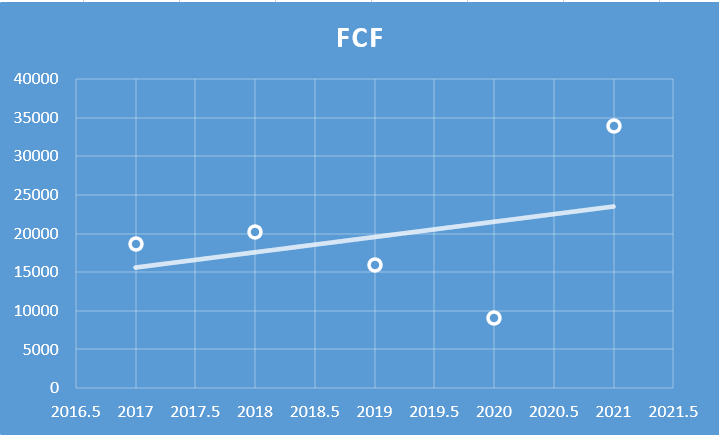

- The increase in cash flow is assumed to be Rs. 783.66 lacs. for the first five years and then Rs 391.83 lacs from sixth to tenth year. The growth rate is based on linear regression analysis of the past Free Cash Flows(refer to figure below) omitting the figures for 2022 where the free cash flow was negative due to pileup of inventories. In the past free cash flow has increased at the rate of Rs. 1567.32 Lacs per year, however, with a conservative outlook we have taken 50% of that figure for the first five years and 25% of that for the next five years.

- Terminal growth rate is assumed to be 0%.

- Discount rate is assumed to be 12%.

- Free Cash Flow is extrapolated with the base value as Rs 12000 Lacs which is 60% of average cash flows from 2017 to 2021. The average of free cash flows for the previous years is Rs. 20000 Lacs.

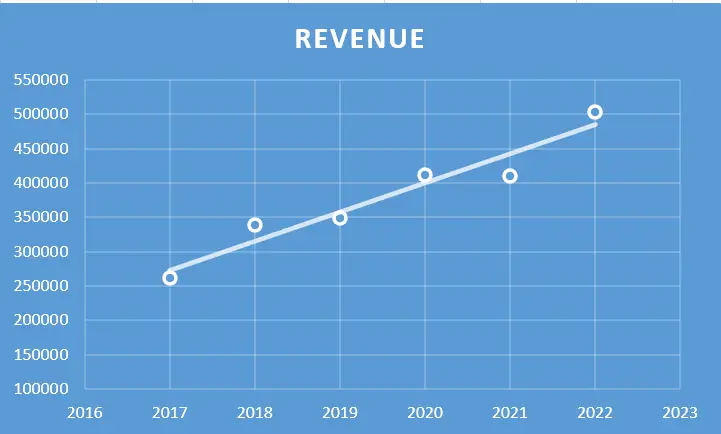

- Increase in Revenue is assumed to be Rs.17680.42 Lacs per year for the first five years and then Rs 8840.21 lacs per year for the next five years. This growth rate is based on linear regression analysis of previous year’s revenues (refer to figure below). In the past free cash flow has increased at the rate of Rs. 35360.84 lacs per year, however, with a conservative outlook we have taken 50% of that figure for the first five years and 25% of that for the next five years.

- Free cash flow will be 4% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.04. Here we assume that the same average will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free cash flows and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Revenue Growth Model

Intrinsic Value: Rs. 134.31

Stock Entry price with 25% margin of safety: Rs.100.73

Free Cash Flow Growth Model

Intrinsic Value: Rs.98.24

Stock Entry price with 25% margin of safety: Rs.73.68

The average of the above two stock entry prices works out to be Rs.87.20. When the stock starts trading below this price it becomes attractive for long term investment.

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer: This is not a stock advise. Investors must use their due diligence before buy/selling any stocks.

References:

https://www.nseindia.com/get-quotes/equity?symbol=AVANTIFEED

More about the Company:

Board Of Directors

Click Here to go to Home Page