Fundamental Analysis And Intrinsic Value of Kanishk Steels Industries Ltd.

Dated: 31 Mar 23

Company: Kanishk Steel Industries Ltd.

CMP: Rs. 23.75

Introduction

In this article we will try to analyze Kanishk Steel Industries Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this analysis we will try to gain insight into the financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment.

Note: Here we are carrying out only the quantitative fundamental analysis of the company as the qualitative analysis is more subjective and individual views may vary vastly.

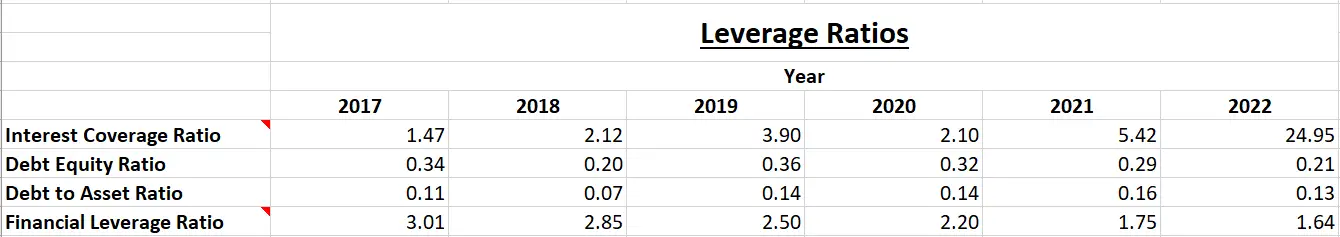

Leverage Ratios

Observations:

- The company has reduced its debt during the period as is evident from the debt equity ratio and this has resulted in reduction in interest outflow from the company which has led to improvement in interest coverage ratio.

- Financial leverage ratio shows that the shareholders equity has improved in comparison to the total assets of the company which is a good sign.

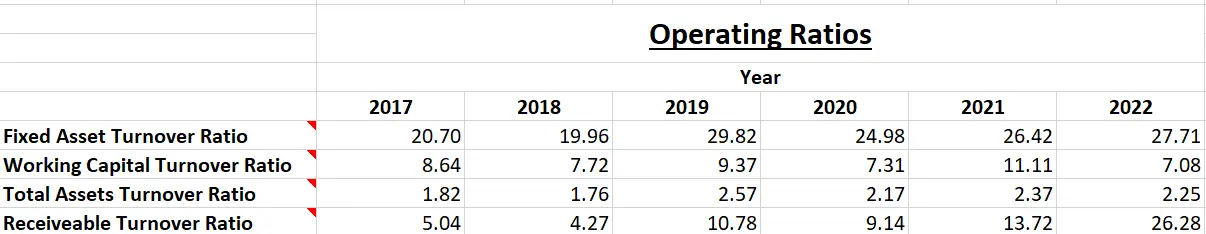

Operating Ratios

Observations:

- All the above ratios indicate an overall improvement in the operating efficiency of the company.

- Only working capital turnover ratio has displayed a slight downward trend. This is because the company is relying on short term debts during the period as it has had patches of negative operating cash flows in the period when it may have needed short term loans to meet the immediate cash requirements.

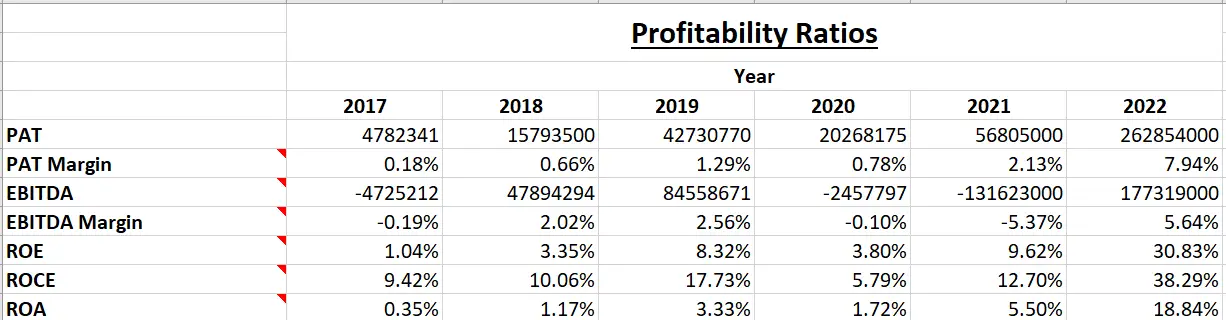

Profitability Ratios

Observations:

- It can be observed that the company had 3 years during this period when it had negative EBITDA and positive PAT. This happens when the operating revenue of the company is not able to cover the operating expenses and the profits are generated due to other income to the company. However Other income is not considered to be a sustainable source for any company. So, the company must try and fix the reasons behind negative EBITDA.

- Year 2022 has been an exceptionally good year as all ratios show a marked improvement over the previous years. However, the improvement in the ratios have not been consistent during the period.

Intrinsic Value

Assumptions:

- Terminal growth rate is assumed to be 0%.

- Discount rate is assumed to be 12%.

- Increase in Revenue is assumed to be Rs.3.1 Crores per year for the first five years and then Rs 1.55 Crores per year for the next five years. This growth rate is based on analysis of previous year’s revenues (refer to figure below). In the past revenue has increased at the rate of Rs. 6.2 Crores per year, however, with a conservative outlook we have taken 50% of that figure for the first five years and 25% of that for the next five years.

- Free cash flow will be 0.3% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.003. Here we assume that the same average will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free cash flows and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Revenue Growth Model

Intrinsic Value: Rs. 3.02

Stock Entry price with 25% margin of safety: Rs.2.26

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer: This is not a stock advise. Investors must use their due diligence before buy/selling any stocks.

References:

http://www.kanishksteels.in/investor-relations.html

More about the Company:

Board Of Directors

Click Here to go to Home Page