Fundamental Analysis And Intrinsic Value of Dhunseri Ventures Ltd.

Dated: 02 Apr 23

Company: Dhunseri Ventures Ltd.

CMP: Rs. 218.05

Introduction

In this article we will try to analyze Dhunseri Ventures Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this analysis we will try to gain insight into the financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment.

Note: Here we are carrying out only the quantitative fundamental analysis of the company as the qualitative analysis is more subjective and individual views may vary vastly.

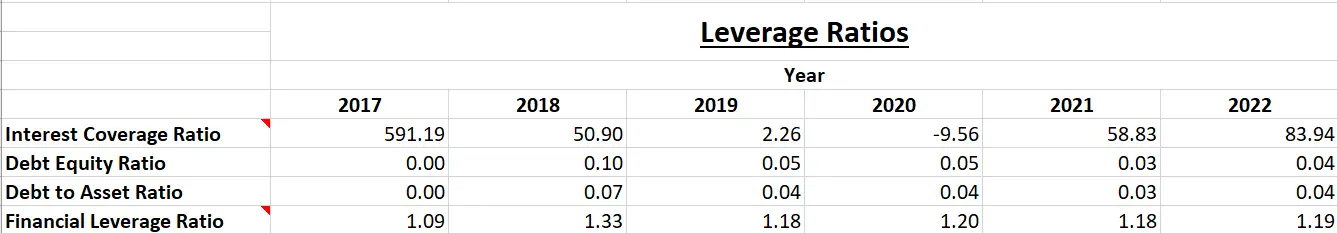

Leverage Ratios

Observations:

- The company has very low debt.

- The negative ICR in 2020 is due to negative PAT for the year, however the company maintains sufficient surplus to meet interest obligations. The same happened in year 2020 when for meeting the obligations, Shareholders Equity took a hit.

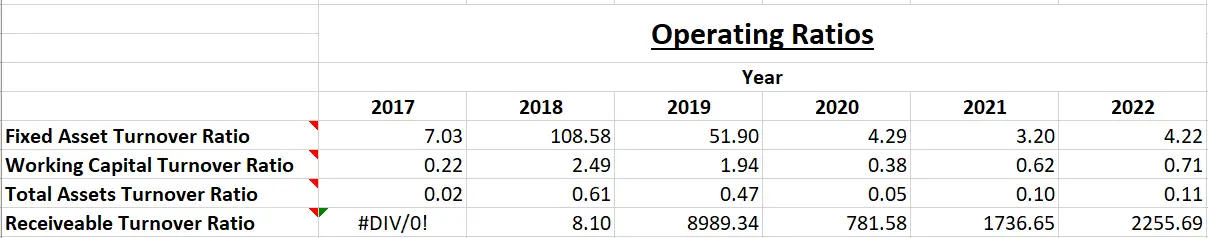

Operating Ratios

Observations:

- The company is maintaining good receivables turnover ratio i.e. it is able to collect the receivables within a short span of time.

- The company is not able to utilize its working capital to the full potential. This is evident from the fact that revenue is mostly less than the available working capital.

- The company has a good fixed assets turnover ratio but a weak total assets turnover ratio this indicates that the company is holding lot of assets that are not included in the category of ‘property, plant and machinery’. This indicates that lot of capital may be locked up un assets that do not contribute to a great extend towards the production of finished products. it may be worthwhile if the company pays a close attention towards this.

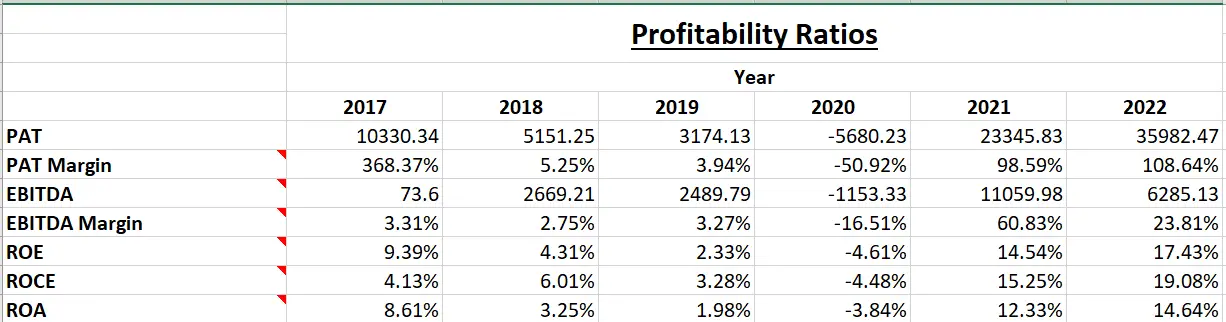

Profitability Ratios

Observations:

- PAT margins have improved post COVID, however it is worth mentioning here that ‘other income’ forms a significant (25%-30%) part of the total income of the company. Since this is not the income generated by the core business, it may not be a reason to cheer if PAT margins are inflated because of other income.

- Other ratios have shown improvement over the pre COVID levels.

Intrinsic Value

Assumptions:

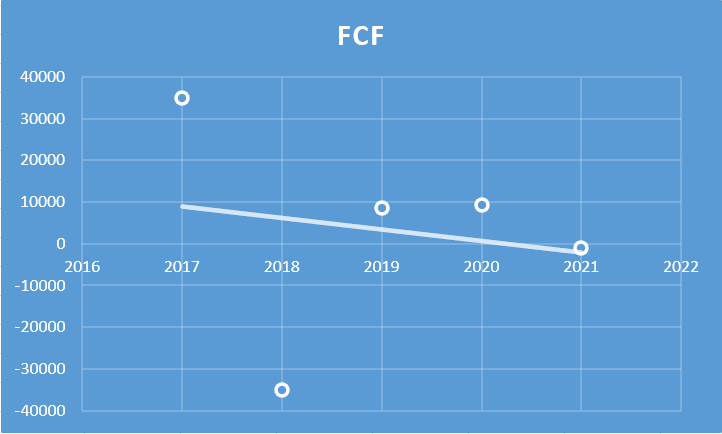

- The increase/(decrease) in cash flow is assumed to be Rs. (1109) Lacs for the first five years and then Rs (554.50) Lacs from sixth to tenth year. The growth rate is projected based on the past Free Cash Flows (refer to figure below). In the past free cash flow has increased/(decrease) at the rate of Rs. (2218) Lacs per year, however, with a moderate outlook we have taken 50% of that figure for the first five years and 25% of that for the next five years.

- Terminal growth rate is assumed to be 0%.

- Discount rate is assumed to be 12%.

- Free Cash Flow is extrapolated with the base value as Rs 10000 Lacs which is same as 2019 and 2020 level. The average of free cash flows for the previous years is Rs. 1052.83 Lacs.

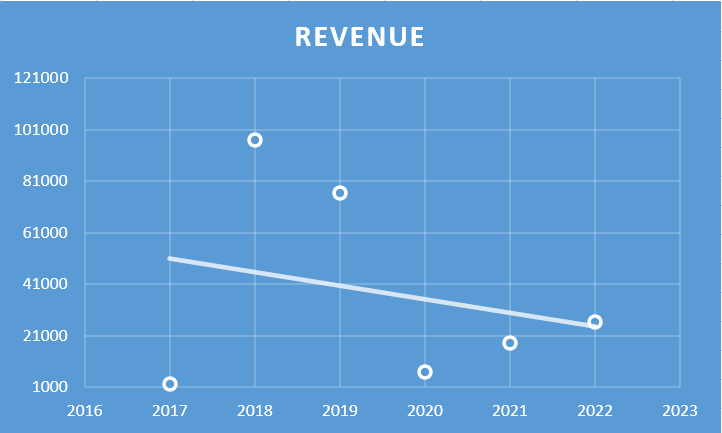

- Increase/(decrease) in Revenue is assumed to be Rs. (2199.73) Lacs per year for the first five years and then Rs (1099.86) Lacs per year for the next five years. This growth rate is based on analysis of previous year’s revenues (refer to figure below). In the past revenue has increased/(decreased) at the rate of Rs. (4399.46) Lacs per year, however, with a moderate outlook we have taken 50% of that figure for the first five years and 25% of that for the next five years.

- Free cash flow will be 13% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.13. Here we assume that the same average will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free cash flows and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Free Cash Flow Growth Model

Intrinsic Value: Rs. 41.69

Stock Entry price with 25% margin of safety: Rs.31.27

Revenue Growth Model

Intrinsic Value: Rs.40.93

Stock Entry price with 25% margin of safety: Rs.30.70

The average of the above two stock entry prices works out to be Rs.30.98. When the stock starts trading below this price it becomes attractive for long term investment.

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer: This is not a stock advise. Investors must use their due diligence before buy/selling any stocks.

References:

https://www.bseindia.com/stock-share-price/dhunseri-ventures-ltd/dvl/523736/financials-results/

More about the Company:

Board Of Directors

Click Here to go to Home Page