Fundamental Analysis And Intrinsic Value of Shreyas Shipping & Logistics Ltd. (2023)

Dated: 12 Jul 23

Company: Shreyas Shipping & Logistics Ltd.

CMP: Rs. 361.70

Market Capitalisation: Rs. 811 Cr.

Intrinsic Value of Shreyas Shipping & Logistics Ltd.

In this article we will try to analyze Shreyas Shipping & Logistics Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this fundamental analysis we will try to gain insight into the financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment.

Shreyas Shipping and Logistics Ltd. is a part of Transworld group with diversified operations in the field of Shipping, Logistics and hospitality. The company primarily focuses on containerised coastal shipping facilitating movement of goods between various major and minor ports of India reducing road congestion and carbon emissions. The company currently operates a fleet of 14 vessels of which two are handysize dry bulk carriers added as a part of business diversification.

Note: Here we are carrying out only the quantitative fundamental analysis of the company as the qualitative analysis is more subjective and individual views may vary vastly.

Before we enter into the calculation of Intrinsic Value of Shreyas Shipping & Logistics Ltd. we have to make some logical assumptions based on the previous six years financial statements and ongoing yield for 10y Government Of India bonds.

Assumptions:

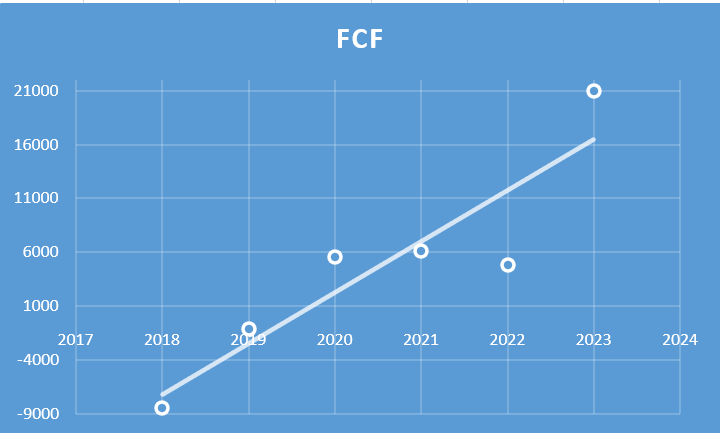

- Terminal growth rate is assumed to be 0%.

- Discount rate is assumed to be 12%.

- The increase in Free Cash Flow is assumed to be Rs. 2371.86 lakhs per year for the first five years and then Rs 1185.93 lakhs from sixth to tenth year. The company has experienced negative free cash flow in year 2022 and 2023 due to more than normal spending on property, plant and machinery. This is in line with the board of directors’ decision to acquire new vessels for long term chartering. For the purpose of calculation of cash flows, it is assumed that the company had an outflow of 7000.00 lakhs and 7500.00 lakhs during year 2022 and 2023 on property, plant and machinery (that is little above average the company usually spends). The figure given below is based on this assumption. In the past Free Cash Flow has increased at the rate of Rs. 4743.71 lakhs per year, however, with a conservative outlook we have taken 50% of that figure for the first five years and 25% of that for the next five years.

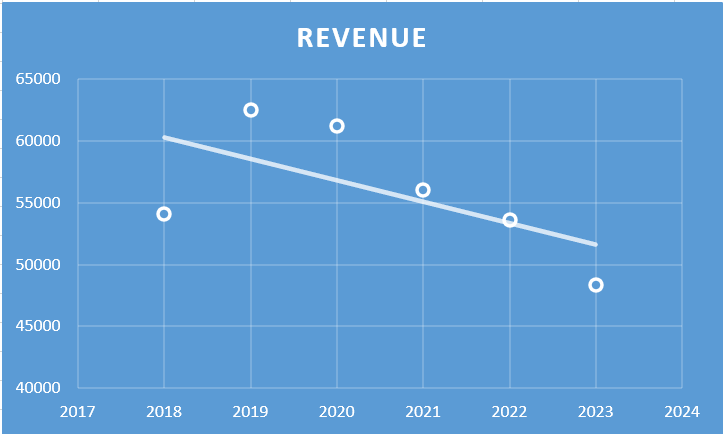

- Increase in Revenue is assumed to be -Rs. 862.23 lakhs per year for the first five years and then -Rs 431.11 lakhs per year for the next five years. This growth rate is based on analysis of previous year’s revenues (refer to figure below). In the past revenue has decreased at the rate of -Rs. 1724.46 lakhs per year, however, with a conservative outlook we have taken 50% of that figure for the first five years and 25% of that for the next five years.

- Free cash flow will be 9% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.09. We assume that this ratio will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free Cash Flow and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Free Cash Flow Growth Model

Intrinsic Value: Rs. 694.25

Stock Entry price with 25% margin of safety: Rs. 520.69

Revenue Growth Model

Intrinsic Value: Rs. 163.76

Stock Entry price with 25% margin of safety: Rs. 122.82

The average of the above two stock entry prices works out to be Rs. 321.76. When the stock starts trading below this price it becomes attractive for long term investment.

***************************************************

Fundamental Analysis Of Shreyas Shipping & Logistics Ltd.

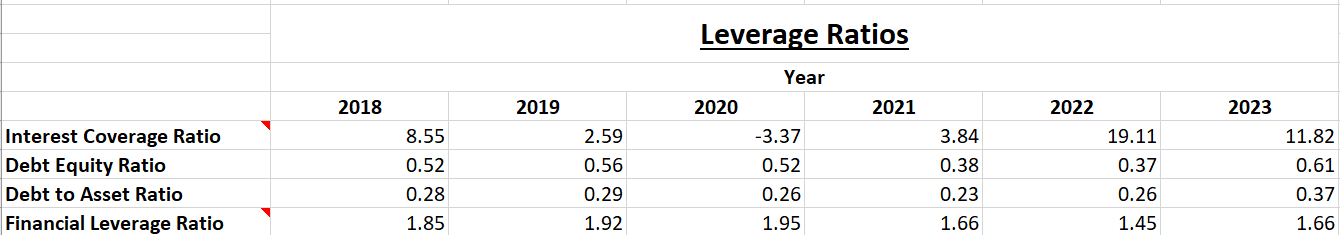

Leverage Ratios

Observations:

- Company is maintaining a low debt level. The Negative interest coverage ratio in year 2020 is because the company had a negative PAT in that year.

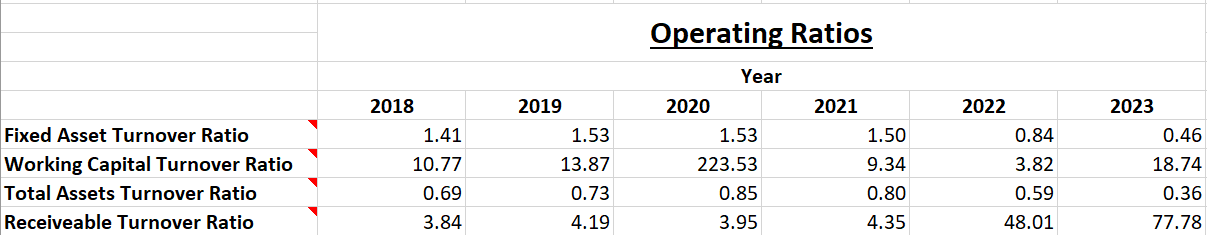

Operating Ratios

Observations:

- The company has maintained a good working capital turnover ratio during the period. The sharp increase in working capital in 2020 is because the company saw an increase in current liabilities and a decrease in current assets during the year. However, post 2020 it has been able to greatly reduce current liabilities.

- There is also a notable improvement in receivable turnover ratio in year 2022 and 2023.

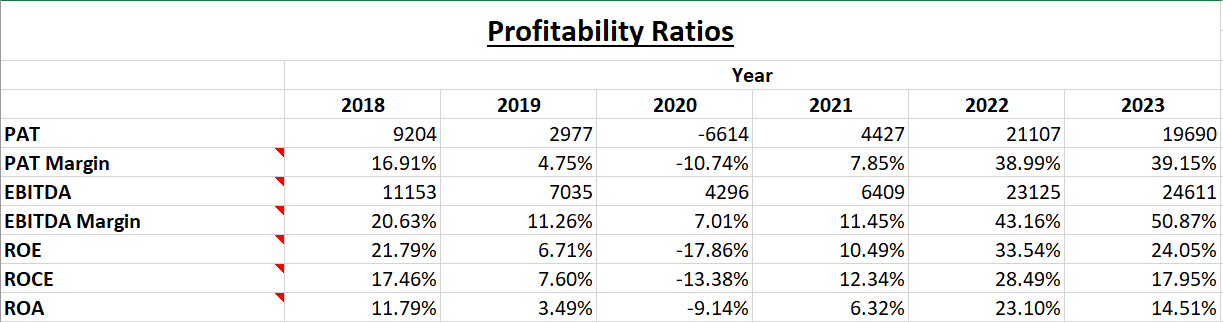

Profitability Ratios

Observations:

- There is remarkable improvement in PAT, EBITDA, PAT margins and EBITDA margins. PAT and EBITDA margins have surpassed pre COVID levels which is a good indication towards overall operating efficiency of the company.

- Other ratios like ROE, ROCE and ROA have shown improvement and reached pre COVID levels.

Author

Jibu Dharmapalan

Fundamental Analyst

If You Like This Content 👇👇👇

Click Here To Join Us on Telegram For Free Live Interactive Discussion And Learning

Disclaimer: This is not a stock advise. Investors must use their due diligence before buy/selling any stocks.

References:

https://www.transworld.com/shreyas-shipping-and-logistics/financial-performance/

More about the Company:

Board Of Directors

|

Ramesh S Ramakrishnan |

Executive Chairman |

|

Capt Milind K Patankar |

Managing Director |

|

Capt Manmohan Saggi |

Independent Director |

|

Maya Swaminathan Sinha |

Independent Director |

|

Deepak Shetty |

Independent Director |

|

Ajith George Paul |

Independent Director |

|

RS Krishnan |

Independent Director |

|

Anisha Ramakrishnan |

Non-Executive Non-Independent Director |

Click here for Home Page.