Fundamental Analysis And Intrinsic Value Of NHPC Ltd.(2023-24)

In this article we will try to analyze NHPC Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this fundamental analysis we will try to gain insight into the business activities, financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment. This article is divided in three sections as listed below :-

Section 1: Qualitative Fundamental Analysis comprising of General Introduction, Business overview dwelling into Business Model, Strengths and Weakness, Long Term Sustainability and finally the competitors.

Section 2:Quantitative Fundamental Analysis on Financial Health, Operating Efficiency And Profitability.

Section 3: Calculation Of Intrinsic Value.

General Introduction

Dated: 26 Nov 23

Company: NHPC Ltd.

CMP: Rs. 54.74

Market Capitalisation: Rs. 54,986.52 Cr.

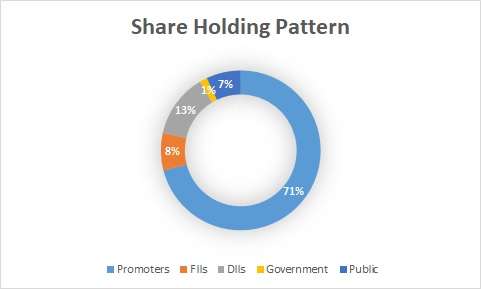

Share Holding Pattern:

Promoters: Government Of India

Top Five Competitors: NTPC Ltd., Power Grid Corporation Of India, Adani Power Ltd., Adani Green Ltd., Tata Power Ltd.

Fundamental Analysis Of NHPC Ltd.

General Introduction:

NHPC, a Mini Ratna category I public sector utility, is Government of India’s flagship hydroelectric generation company. The company is primarily involved in the generation and sale of bulk power to various Power Utilities. Its other business includes providing project management / construction contracts/ consultancy assignment services and trading of power.

NHPC’s hydro share of about 7000 MW comes to about 15% of the country;s total installed hydro capacity. It is presently engaged in the construction of 15 projects aggregating to a total capacity of 10500 MW. This includes nine hydro electric projects, six solar projects.

In addition thirteen projects aggregating to a total of 4847 MW is under clearance stage including both hydro electric power and solar power stations.

Business Overview:

The company specializes in hydroelectric power generation and presently manages 22 power stations strategically positioned throughout the country. Given the untapped hydroelectric potential in the nation, there is significant growth potential for the company in establishing new projects. Leveraging its extensive expertise in hydroelectric power projects—from conceptualization to commissioning, including in-house design, engineering, and geological technical studies—the company offers a comprehensive end-to-end solution for hydroelectric projects.

Moreover, the company is expanding its portfolio to include other renewable energy sources such as wind and solar. It has successfully established one power generation facility for each, demonstrating its commitment to diversification. Additionally, the company has entered the realm of power trading and holds a license as a member of the Indian Energy Exchange.

An essential aspect highlighting the indispensability of hydel power units in the future reliance on renewable energy sources is the necessity for Grid Balancing. The intermittent nature of solar and wind power can lead to imbalances on the electric grid, making hydel power units crucial for maintaining stability.

The Government has also extended helping hand to power generation companies and asked power distribution companies to make timely payment to Power Generation Companies failing which they have been asked to liquidate the LCs provided by the DISCOMs.

With its strengths, diverse energy portfolio, and the vast untapped growth potential within the country, the company is poised for promising future growth.

****************************************************

Financial Ratios

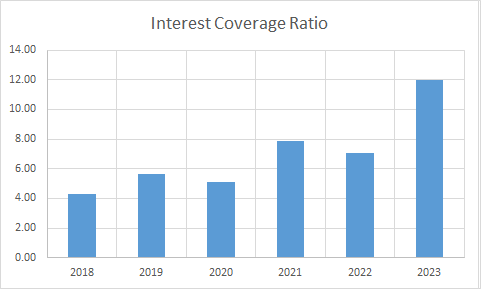

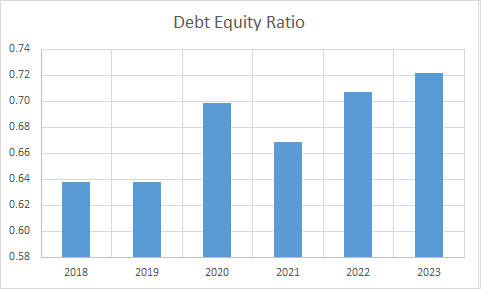

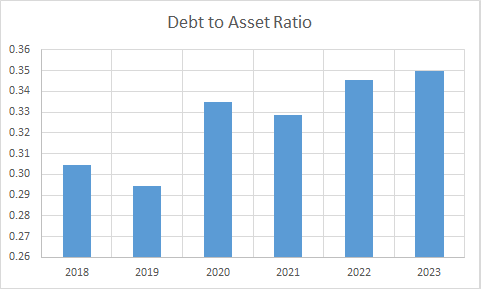

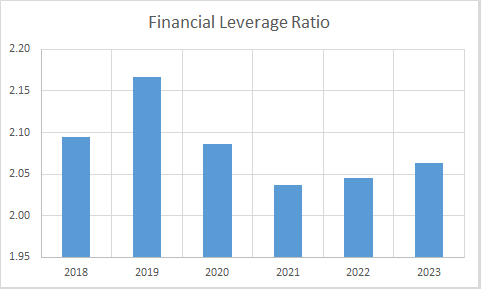

Leverage Ratios

Observations:

- Company is maintaining a healthy interest coverage ratio despite the fact that the debt on the company is gradually increasing. It has to take measures to bring down the debt levels. This may also be due to the fact that the company has been spending on Capex during this period as a part of installation of new projects.

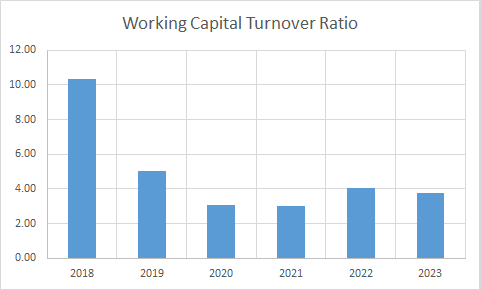

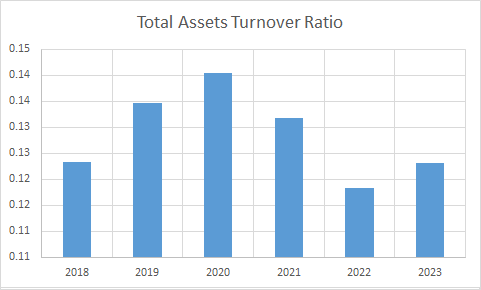

Operating Ratios

Observations:

- Fixed assets turnover ratio has improved during the period indicating that the company is efficiently utilising its assets.

- Working capital turnover has declined despite increase in current assets with respect to current liabilities indicating that the revenue increase has not been commensurate with the increase in working capital.

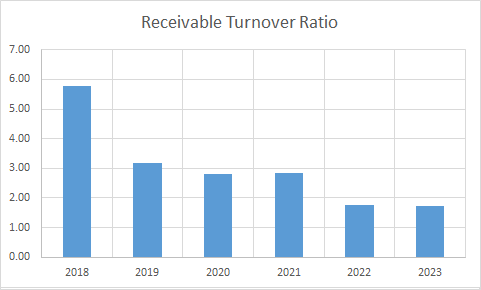

- Receivable turnover ratio has reduced indicating that the company has been extending credit and has to tighten its credit norms.

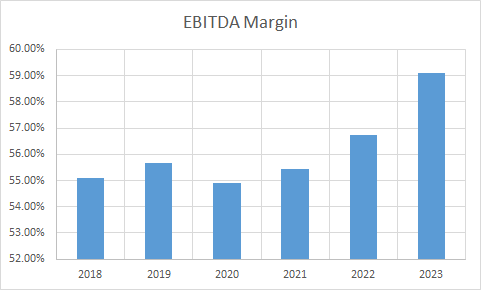

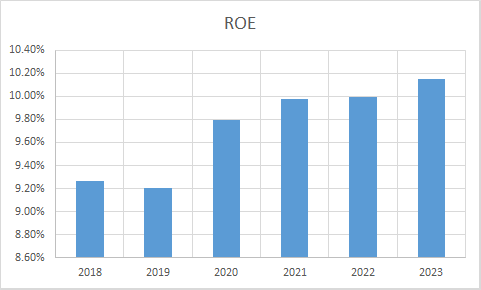

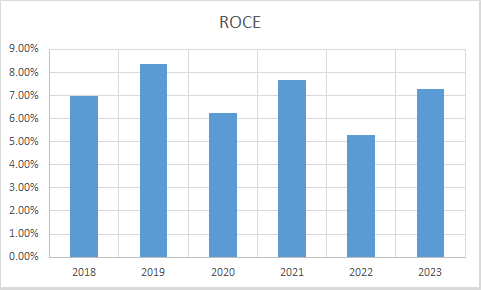

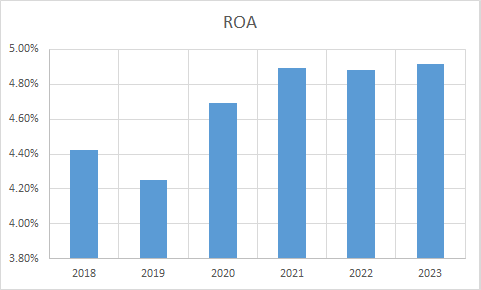

Profitability Ratios

Observations:

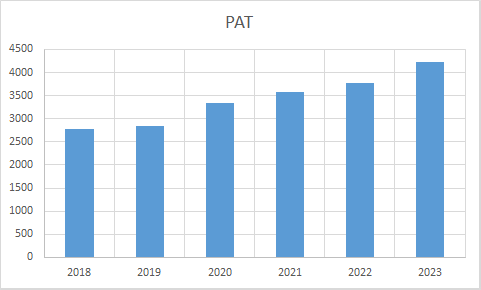

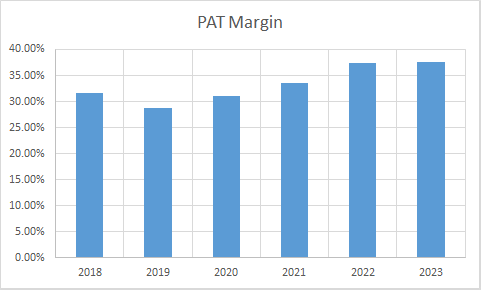

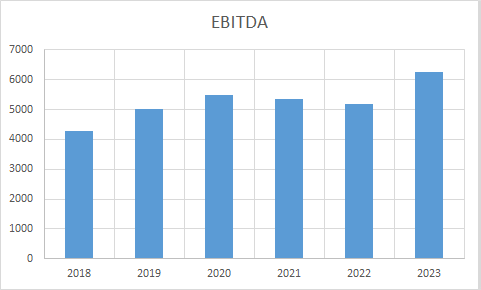

- The company has been operating with handsome PAT and EBITDA margin and both have shown improvement during the period under observation. One of the reasons for high PAT and EBITDA margin is the fact that the company owns and operates hydel power stations and dams that require heavy initial investment but not much of a running cost in comparison.

- ROCE is low since the company operates in a capital intensive industry.

****************************************************

Intrinsic Value of NHPC Ltd.

Before we enter into the calculation of Intrinsic value of NTPC Ltd. we have to make some logical assumptions based on the previous six years financial statements and ongoing yield for 10y Government Of India bonds.

Assumptions:

- Terminal growth rate is assumed to be 0%.

- Weighted Average Cost of Capital(WACC) is assumed to be 12%.

- Free cash flow will be 43% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.43. We assume that this ratio will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free Cash Flow and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Free Cash Flow Growth Model

Intrinsic Value: Rs. 32.21

Stock Entry price with 25% margin of safety: Rs. 24.16

Revenue Growth Model

Intrinsic Value: Rs. 40.86

Stock Entry price with 25% margin of safety: Rs. 30.65

The intrinsic values arrived above are not the same since the Free Cash Flow model considers a pessimistic starting base value of present free cash flow for extrapolation whereas the Revenue Growth model takes the actual point on the extrapolation line for the current year. The average of the above two stock entry prices works out to be Rs. 27.40. When the stock starts trading below this price it becomes attractive for long term investment. This value is valid till the next financial year results are published or some major fundamental change takes place in the company.

****************************************************

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer:

This article is for educational purpose only. Investment in securities market is subject to market risks. Please consult your Financial Advisor before investing.

If You Like This Content 👇👇👇

Click Here To Join Us on Facebook For Free Live Interactive Discussion And Learning

References:

https://www.bseindia.com/stock-share-price/nhpc-ltd/nhpc/533098/financials-annual-reports/

https://www.nhpcindia.com/welcome/rkive/111

Click Here for Home

FAQs

What is Intrinsic Value?

Ans: When someone invests in an asset, he does so in order to earn money from the business. The investor gets paid over a period of time as long as he is invested in the asset. Now intrinsic value is the present value of all such future cash flows generated by the asset. So logically one should not invest in any asset if the ask price is more than the intrinsic value of the asset.

How is Intrinsic Value of a company calculated?

Ans: For calculating the intrinsic value of a company all its future cash flows are extrapolated based on the past performance of the company, assumptions about the future growth of the company and its terminal value. Once all these are calculated these are brought to the present date based on appropriate discounting rate. The sum of all these gives the intrinsic value of the company. It may be more or less than the market capitalization of the company. If it is more than the market capitalization of the company then the company is said to be undervalued and is a good bet as a long-term investment and vice versa.

How is Intrinsic Value of a share calculated?

Ans: Once intrinsic value of a company is calculated as explained above, it is divided by the total number of outstanding shares of the company. This gives the intrinsic value of a share.

What is Discounted Cash Flow?

Ans: When we have cash flows that are spread over a period of time then Discounted Cash Flow method is used to calculate present value of all such cash flows. The present value depends on the discounting rate used. Usually 10 year Government bond yield rate(risk free rate of return) is used as the discounting rate.