Fundamental Analysis And Intrinsic Value Of Great Eastern Shipping Co. Ltd.(2023-24)

In this article we will try to analyze GE Shipping Co. Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this fundamental analysis we will try to gain insight into the business activities, financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment. This article is divided in three sections as listed below :-

Section 1: Qualitative Fundamental Analysis comprising of General Introduction, Business overview dwelling into Business Model, Strengths and Weakness, Long Term Sustainability and finally the competitors.

Section 2:Quantitative Fundamental Analysis on Financial Health, Operating Efficiency And Profitability.

Section 3: Calculation Of Intrinsic Value.

General Introduction

Dated: 29 Nov 23

Company: Great Eastern Shipping Co. Ltd.

CMP: Rs. 814.00

Market Capitalisation: Rs. 11963.07 Cr.

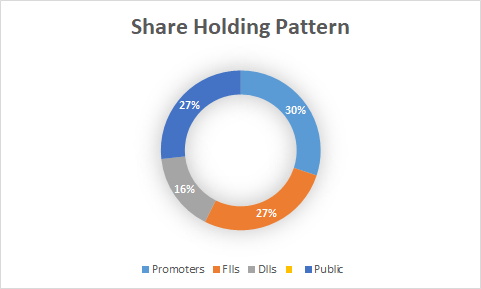

Share Holding Pattern:

Promoters: Ravi K Sheth, Bharat K Sheth, Laadki Trading And Investments Ltd.

Top Five Competitors: SCI Ltd., Seamec Ltd., Shreyas Shipping Ltd., Essar Shipping Ltd.

Fundamental Analysis Of Great Eastern Shipping Co. Ltd.

General Introduction:

Great Eastern Shipping Company Limited, commonly known as GE Shipping, stands as a beacon of maritime excellence with a rich history that spans over seven decades. Over the years, it has experienced remarkable growth, diversifying its fleet and expanding its services to become one of the largest and most respected shipping companies in India. The company boasts a diverse fleet, including bulk carriers, tankers, offshore support vessels, and liquefied petroleum gas carriers. The company operates in regions such as Asia, Europe, Africa, and the Americas, facilitating the smooth movement of goods and commodities on a global scale. The company serves a broad spectrum of industries, including oil and gas, mining, agriculture, and manufacturing. Its commitment to reliability, safety, and timely delivery has established long-standing partnerships with leading global corporations.

Business Overview:

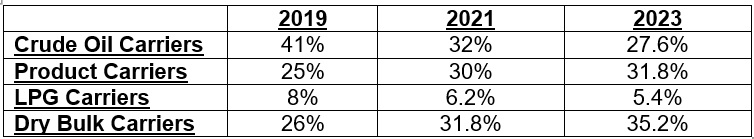

Great Eastern Shipping Co. Ltd. stands as a stalwart in the cargo shipping industry, boasting a remarkable legacy since its inception in 1948. As a testament to its resilience, the company has weathered various business cycles and political upheavals, emerging as one of the few shipping companies worldwide with a 75-year track record. The shipping industry, though subject to changes in propulsion systems due to technological advancements, is projected to endure indefinitely, ensuring the continued relevance of companies like GE Shipping.GE Shipping operates the following type of carriers and their percentage share in the fleet is given below:

As of now the company operates 43 Ships with an average age of 13.34 years. Apart from these it holds 19 offshore support vessels with average age of 13.13 years, and 4 drilling units with average age of 11.45 years and an anchor handling tug cum supply vessel through its subsidiaries. The company keeps changing its fleet mix based on the managements assessment of future requirements.

To navigate the inherent risks associated with the shipping industry, GE Shipping employs a robust risk mitigation strategy. Diversifying revenue sources through freight rental and charter contracts ranging from 6 months to 3 years helps cushion the impact of market fluctuations. The company recognizes that a substantial portion of returns stems from asset appreciation, sometimes realized through asset sales, contributing to the profit and loss statement. Furthermore, a depreciation in the Indian Rupee against the USD serves as an additional profit driver, given that all company assets are valued in USD.

Despite the myriad challenges posed by global economic growth uncertainties, geopolitical risks in oil-producing regions, and trade disputes between nations, GE Shipping, with its extensive experience, remains poised to tackle such adversities. The company’s long-standing presence in the market underscores the management’s adeptness in navigating through similar challenges in the past, instilling confidence in its ability to confront and overcome future uncertainties.

****************************************************

Financial Ratios

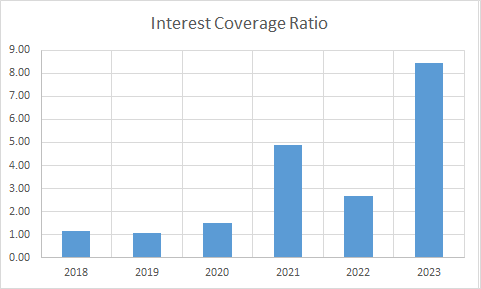

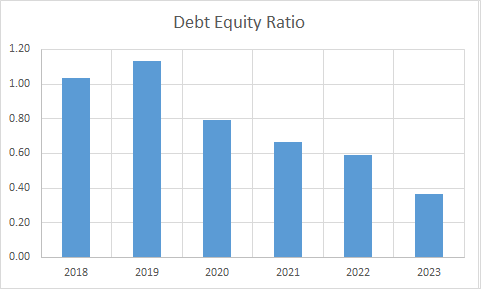

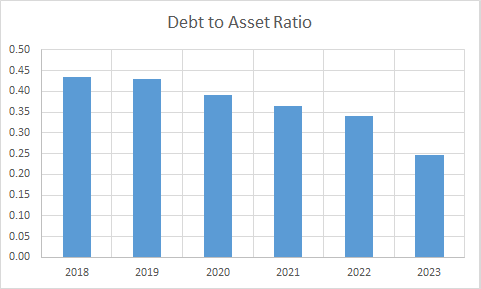

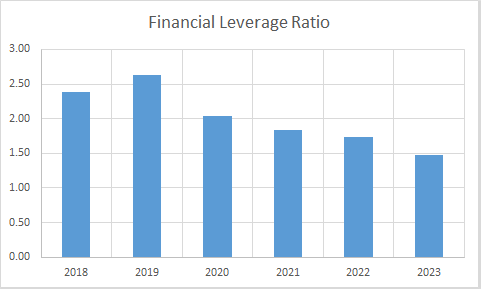

Leverage Ratios

Observations:

- The company has been able to bring down its debt burden and the interest coverage ratio has improved during this period.

- The debt has come down in absolute terms in the balance sheet and has almost become half, which is a remarkable achievement.

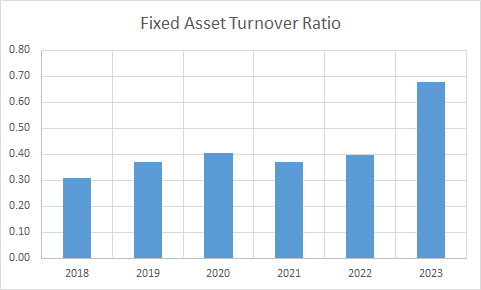

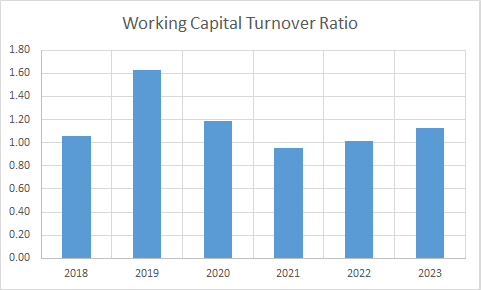

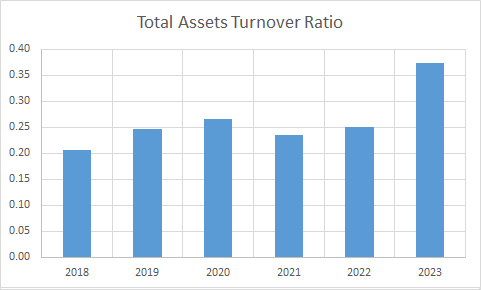

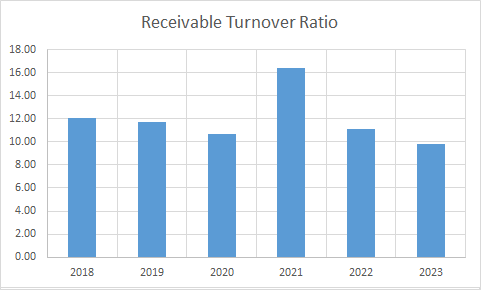

Operating Ratios

Observations:

- Since shipping is a capital intensive industry the asset turnover ratios are low.

- The company is maintaining a positive working capital indicating that it has sufficient current assets to meet immediate liabilities.

- Company is maintaining a healthy receivable turnover ratio.

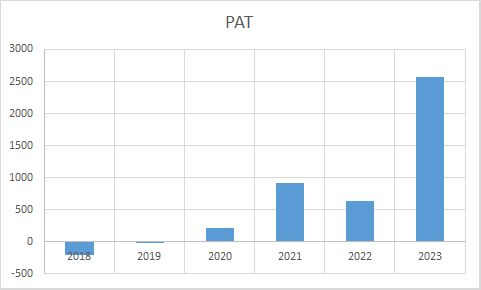

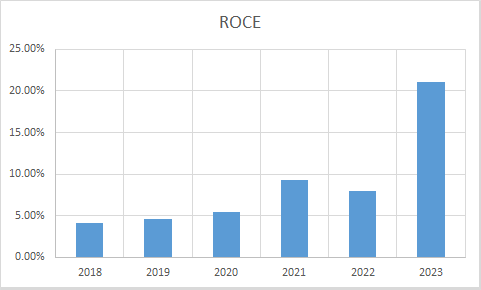

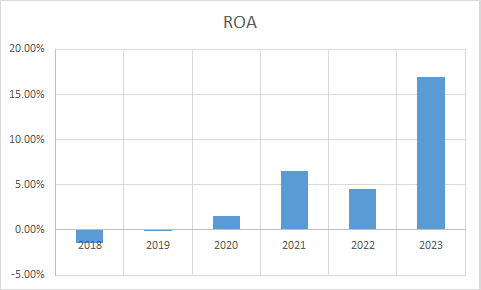

Profitability Ratios

Observations:

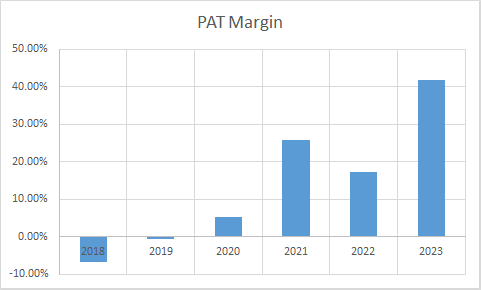

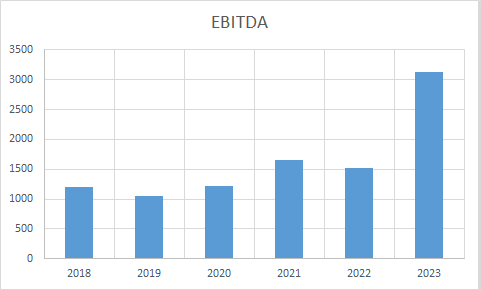

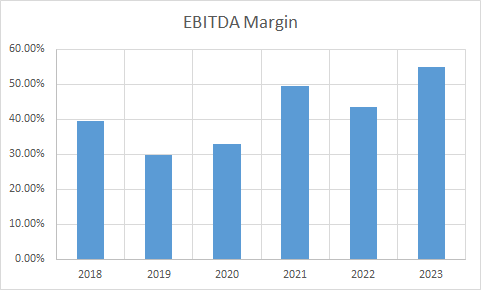

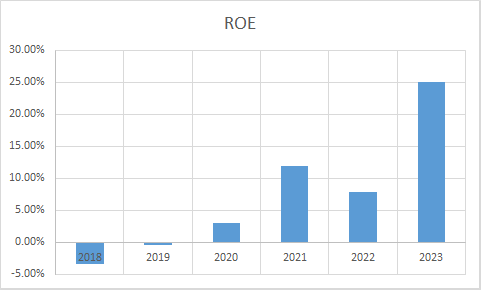

- PAT margins have shown a commendable improvement during the period.

****************************************************

Intrinsic Value of Great Eastern Shipping Co. Ltd.

Before we enter into the calculation of Intrinsic value of Great Eastern Shipping Co. Ltd. we have to make some logical assumptions based on the previous six years financial statements and ongoing yield for 30y Government Of India bonds.

Assumptions:

- Terminal growth rate is assumed to be 0%.

- Weighted Average Cost of Capital(WACC) is assumed to be 12%.

- Free cash flow will be 41% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.41. We assume that this ratio will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free Cash Flow and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Free Cash Flow Growth Model

Intrinsic Value: Rs. 1244.99

Stock Entry price with 25% margin of safety: Rs. 933.74

Revenue Growth Model

Intrinsic Value: Rs. 1366.53

Stock Entry price with 25% margin of safety: Rs. 1024.90

The intrinsic values arrived above are not the same since the Free Cash Flow model considers a pessimistic starting base value of present free cash flow for extrapolation whereas the Revenue Growth model takes the actual point on the extrapolation line for the current year. The average of the above two stock entry prices works out to be Rs. 979.32. When the stock starts trading below this price it becomes attractive for long term investment. This value is valid till the next financial year results are published or some major fundamental change takes place in the company.

****************************************************

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer:

This article is for educational purpose only. Investment in securities market is subject to market risks. Please consult your Financial Advisor before investing.

If You Like This Content 👇👇👇

Click Here To Join Us on Facebook For Free Live Interactive Discussion And Learning

References:

https://www.bseindia.com/stock-share-price/great-eastern-shipping-coltd/geship/500620/financials-annual-reports/

https://www.greatship.com/investors.html#financial_result

Click Here for Home

FAQs

What is Intrinsic Value?

Ans: When someone invests in an asset, he does so in order to earn money from the business. The investor gets paid over a period of time as long as he is invested in the asset. Now intrinsic value is the present value of all such future cash flows generated by the asset. So logically one should not invest in any asset if the ask price is more than the intrinsic value of the asset.

How is Intrinsic Value of a company calculated?

Ans: For calculating the intrinsic value of a company all its future cash flows are extrapolated based on the past performance of the company, assumptions about the future growth of the company and its terminal value. Once all these are calculated these are brought to the present date based on appropriate discounting rate. The sum of all these gives the intrinsic value of the company. It may be more or less than the market capitalization of the company. If it is more than the market capitalization of the company then the company is said to be undervalued and is a good bet as a long-term investment and vice versa.

How is Intrinsic Value of a share calculated?

Ans: Once intrinsic value of a company is calculated as explained above, it is divided by the total number of outstanding shares of the company. This gives the intrinsic value of a share.

What is Discounted Cash Flow?

Ans: When we have cash flows that are spread over a period of time then Discounted Cash Flow method is used to calculate present value of all such cash flows. The present value depends on the discounting rate used. Usually 10 year Government bond yield rate(risk free rate of return) is used as the discounting rate.