Fundamental Analysis And Intrinsic Value Of Godrej Agrovet Ltd.(2023-24)

In this article we will try to analyze Godrej Agrovet Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this fundamental analysis we will try to gain insight into the business activities, financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment. This article is divided in three sections as listed below :-

Section 1: Qualitative Fundamental Analysis comprising of General Introduction, Business overview dwelling into Business Model, Strengths and Weakness, Long Term Sustainability and finally the competitors.

Section 2:Quantitative Fundamental Analysis on Financial Health, Operating Efficiency And Profitability.

Section 3: Calculation Of Intrinsic Value.

General Introduction

Dated: 20 Dec 23

Company: Godrej Agrovet Ltd.

CMP: Rs. 559.75

Market Capitalisation: Rs. 10759.00 Cr.

Share Holding Pattern:

Promoters: Adi Godrej, Nadir Godrej, Jamshyd Godrej, Tanya Dubash

Top Five Competitors: Avanti Feeds, KSE, Unique Organics

Fundamental Analysis Of Godrej Agrovet Ltd.

General Introduction:

Established in 1991, Godrej Agrovet has emerged as a prominent player in the agri-business sector, contributing significantly to India’s agricultural landscape. Founded with the objective of providing end-to-end solutions to farmers, the company has steadily grown to become a leading player in various segments of the agri-business industry. The company operates five verticals viz. Animal feed, oil palm, crop protection, dairy and poultry & processed food and has widespread presence in Bharat with production facilities as well as distributor network.

Business Overview:

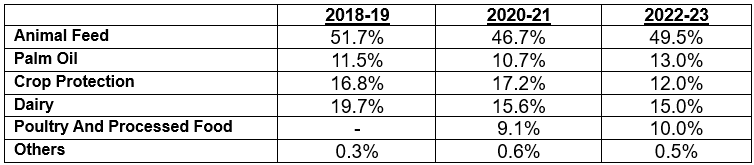

Godrej Agrovet Ltd. stands as a key vertical within the broader Godrej Group, focusing on the agricultural sector and its associated products. The company derives its revenue from five primary streams: animal feed, palm oil, crop protection, dairy, and poultry & processed food. Notably, animal feed constitutes 50% of the company’s revenue, supported by over 30 plants and a network of 6200 distributors nationwide.

Within its Animal Feed business, the company offers a diverse range of products, including Cattle Feed, Poultry Feed, Aqua Feed, and Specialty Feed. Boasting a pan-India presence, Godrej Agrovet Ltd. maintains a well-rounded product portfolio in the agriculture sector. This, coupled with its established research and development facility, provides the company with a distinct advantage over its competitors.

The breakdown of revenue streams is given below –

It is noteworthy that the company’s product mix and operational focus in the agriculture sector are poised to withstand the test of time, meeting essential requirements for both agricultural and household needs. Additionally, the company is well-prepared for the future with ongoing technological advancements that are expected to enhance its resilience rather than render it obsolete.

While the company encounters challenges such as the improper handling, processing, or storage of raw materials or products, as well as unfavorable local and global weather patterns, these hurdles are anticipated to be overcome with evolving technologies. The company remains adaptable, poised to address these challenges and continue its trajectory of growth in the agricultural landscape.

****************************************************

Financial Ratios

Leverage Ratios

Observations:

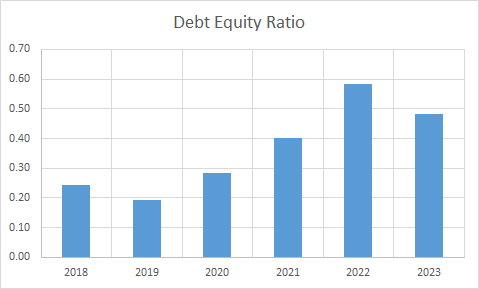

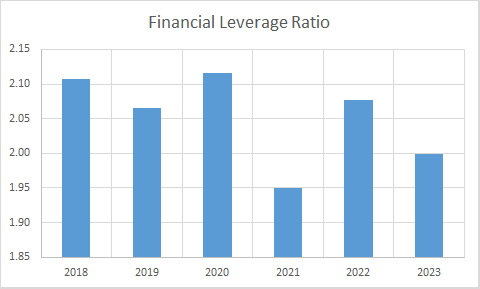

- Though the debt on the company is below critical level, however, it has gone up during the period under observation.

- The earnings of the company has not improved in proportion to debt as a result the interest coverage ratio has declined during this period.

Operating Ratios

Observations:

- The company has been working with a negative working capital for most of the period in consideration. Advances made by creditors against orders has major contribution towards negative working capital.

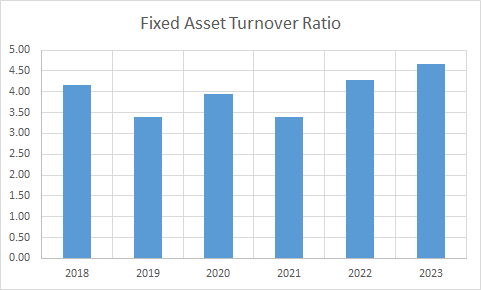

- Receivable turnover ratio has improved during the period.

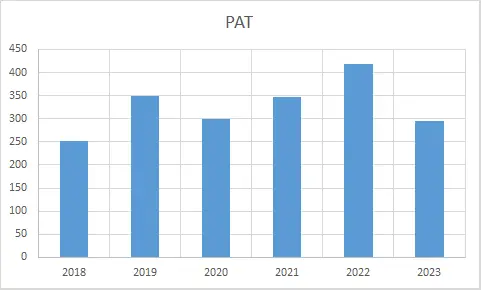

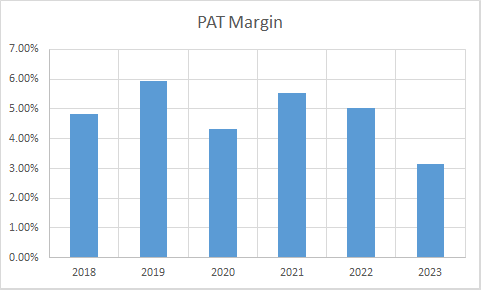

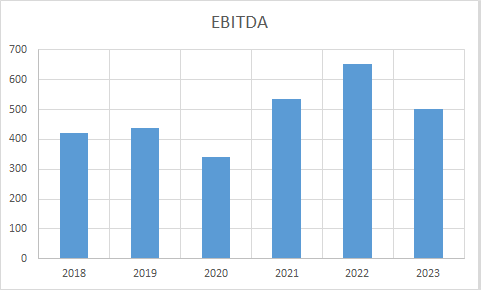

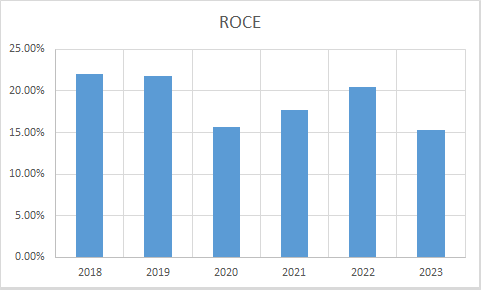

Profitability Ratios

Observations:

- The company is operating on lean margins indicating tough competition.

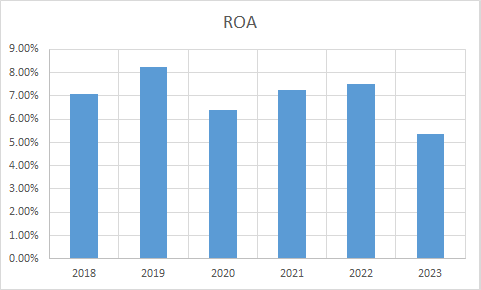

- ROE, ROCE and ROA have been stable during this period.

****************************************************

Intrinsic Value of Godrej Agrovet Ltd.

Before we enter into the calculation of Intrinsic value of Godrej Agrovet Ltd. we have to make some logical assumptions based on the previous six years financial statements and ongoing yield for 30y Government Of India bonds.

Assumptions:

- Terminal growth rate is assumed to be 0%.

- Weighted Average Cost of Capital(WACC) is assumed to be 12%.

- Free cash flow will be 5% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.05. We assume that this ratio will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free Cash Flow and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Free Cash Flow Growth Model

Intrinsic Value: Rs. 154.60

Stock Entry price with 25% margin of safety: Rs. 115.95

Revenue Growth Model

Intrinsic Value: Rs. 223.73

Stock Entry price with 25% margin of safety: Rs. 167.79

The intrinsic values arrived above are not the same since the Free Cash Flow model considers a pessimistic starting base value of present free cash flow for extrapolation whereas the Revenue Growth model takes the actual point on the extrapolation line for the current year. The average of the above two stock entry prices works out to be Rs. 141.87. When the stock starts trading below this price it becomes attractive for long term investment. This value is valid till the next financial year results are published or some major fundamental change takes place in the company.

****************************************************

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer:

This article is for educational purpose only. Investment in securities market is subject to market risks. Please consult your Financial Advisor before investing.

If You Like This Content 👇👇👇

Click Here To Join Us on Facebook For Free Live Interactive Discussion And Learning

References:

https://www.godrejagrovet.com/investors/annual-reports

Click Here for Home

FAQs

What is Intrinsic Value?

Ans: When someone invests in an asset, he does so in order to earn money from the business. The investor gets paid over a period of time as long as he is invested in the asset. Now intrinsic value is the present value of all such future cash flows generated by the asset. So logically one should not invest in any asset if the ask price is more than the intrinsic value of the asset.

How is Intrinsic Value of a company calculated?

Ans: For calculating the intrinsic value of a company all its future cash flows are extrapolated based on the past performance of the company, assumptions about the future growth of the company and its terminal value. Once all these are calculated these are brought to the present date based on appropriate discounting rate. The sum of all these gives the intrinsic value of the company. It may be more or less than the market capitalization of the company. If it is more than the market capitalization of the company then the company is said to be undervalued and is a good bet as a long-term investment and vice versa.

How is Intrinsic Value of a share calculated?

Ans: Once intrinsic value of a company is calculated as explained above, it is divided by the total number of outstanding shares of the company. This gives the intrinsic value of a share.

What is Discounted Cash Flow?

Ans: When we have cash flows that are spread over a period of time then Discounted Cash Flow method is used to calculate present value of all such cash flows. The present value depends on the discounting rate used. Usually 10 year Government bond yield rate(risk free rate of return) is used as the discounting rate.

Good analysis Jibu.