Fundamental Analysis And Intrinsic Value Of Godrej Consumer Products Ltd. (2023-24)

In this article we will try to analyze Godrej Consumer Products Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this fundamental analysis we will try to gain insight into the business activities, financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment. This article is divided in three sections as listed below :-

Section 1: Qualitative Fundamental Analysis comprising of General Introduction, Business overview dwelling into Business Model, Strengths and Weakness, Long Term Sustainability and finally the competitors.

Section 2:Quantitative Fundamental Analysis on Financial Health, Operating Efficiency And Profitability.

Section 3: Calculation Of Intrinsic Value.

General Introduction

Dated: 23 Dec 23

Company: Godrej Consumer Products Ltd.

CMP: Rs. 1073.90

Market Capitalisation: Rs. 1,09,840.68 Cr.

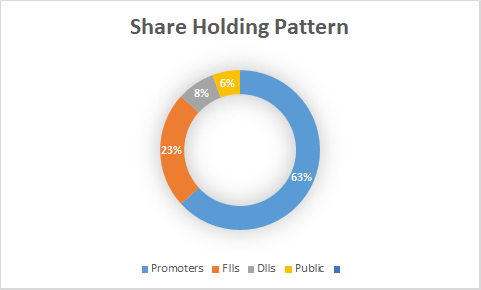

Share Holding Pattern:

Promoters: Nisaba Godrej, Nadir Godrej, Tanya Dubash, Pirojsha Godrej, Jamshyd Godrej

Top Five Competitors: Emami, Kaya, Jyothy Labs, HUL

Fundamental Analysis Of Godrej Consumer Products Ltd.

General Introduction:

Godrej Consumer Products Ltd. is a part of over 124-year-old Godrej Group. Today the group enjoys the patronage of over 1.2 billion consumers globally across different businesses. As a part of planned strategy, the company is building presence in three emerging markets Asia, Africa and Latin America across three categories viz. home care, personal care and hair care.

The company ranks among the largest household insecticide and hair care player in emerging markets. In household insecticides it is the leader in India and Indonesia and is expanding its footprints in Africa. It is the leader in serving the hair care needs of women of African descent and number one player in hair colour products in India and Africa and among leading players in Latin America. It also ranks second in air fresheners, soaps and liquid detergents in India and first in air fresheners in Indonesia.

Business Overview:

In the dynamic landscape of Fast-Moving Consumer Goods (FMCG), Godrej Consumer Products Ltd. stands tall as a frontrunner in Bharat, boasting four key verticals: Household Insecticides, Personal Care, Hair Care, and Air Care. The company’s diverse product portfolio includes household names such as Good Knight Mosquito Repellent, Godrej Expert Hair Dye, Hit, Godrej No.1 Soap, Cinthol, Ezee Fabric Softener, and Aer Room Freshener.

Godrej Consumer Products Ltd. has successfully carved out a niche for itself, securing the top position in each respective category and establishing a formidable business moat. The company’s commitment to excellence extends beyond its product offerings, encompassing innovation in management, marketing, distribution, and product development.

In alignment with its long-term strategy, the company has set its sights on emerging markets in Asia, South America, and Africa. The goal is to capitalize on the growth of the emergent consumer class in these regions. Notably, Godrej Consumer Products Ltd. has consistently demonstrated a proactive approach to expansion, as exemplified by its recent acquisition of the Park Avenue and Kamasutra brands from Raymond Consumer Care Ltd. This strategic move has propelled the company into the men’s deodorant and sexual wellness segments, broadening its market presence.

A hallmark of Godrej Consumer Products Ltd. is its dedication to research and development (R&D). The company allocates significant resources to nurture new ideas, with an impressive 20% of its revenue stemming from products developed in the last five years. This commitment underscores its agility in adapting to changing consumer preferences and market dynamics.

Beyond the borders of the Bhartiya subcontinent, the company has set a deliberate course for international expansion. In 2009, a mere 22% of its revenue was generated from overseas markets. Today, that figure has surged to nearly 45%, signifying the successful execution of Godrej Consumer Products Ltd.’s global growth strategy.

The company has also emphasized on the need to diversify into more verticals to meet the evolving requirements of consumers. The product wise breakup of revenue as compared to 2009 is given below –

As we witness the company’s unwavering commitment to innovation, strategic acquisitions, and global expansion, it is evident that Godrej Consumer Products Ltd. continues to play a leading role in the FMCG industry. With a foundation built on excellence and a vision geared towards the future, the company remains poised for sustained success in the ever-evolving consumer goods landscape.

****************************************************

Financial Ratios

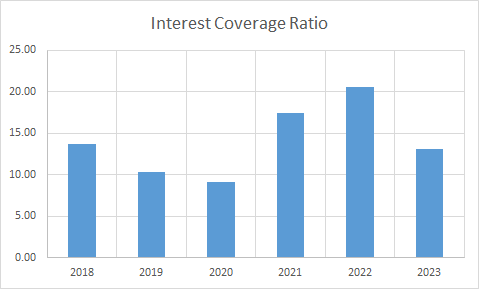

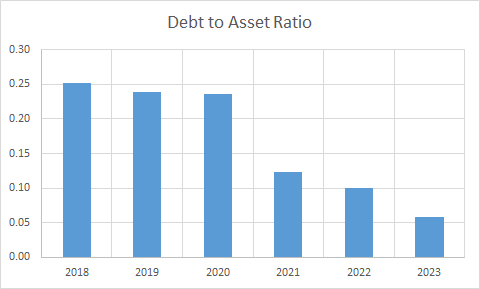

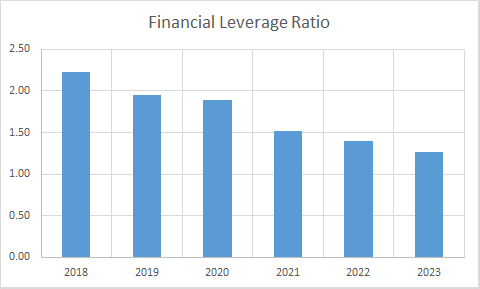

Leverage Ratios

Observations:

- The company has managed to bring down its debt levels to a great extent.

- It is maintaining a healthy interest coverage ratio.

Operating Ratios

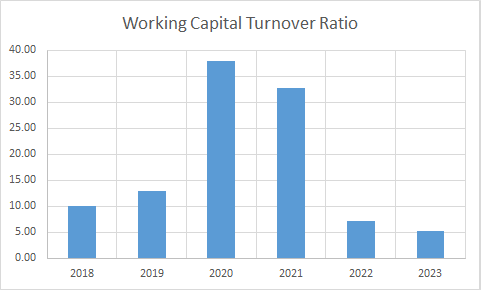

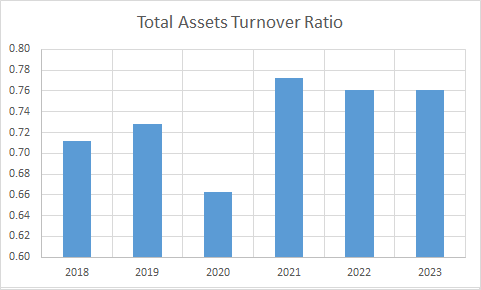

Observations:

- The company has been maintaining a positive working capital throughout.

- Receivable turnover ratio has improved during the period.

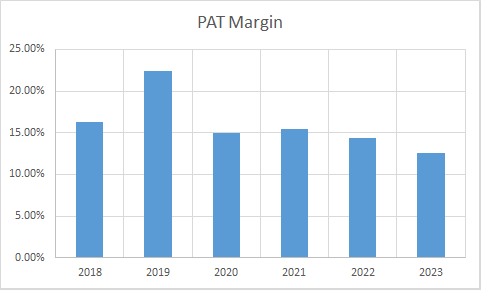

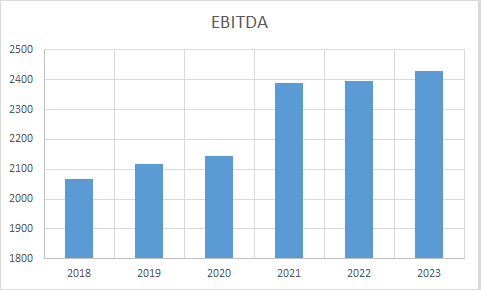

Profitability Ratios

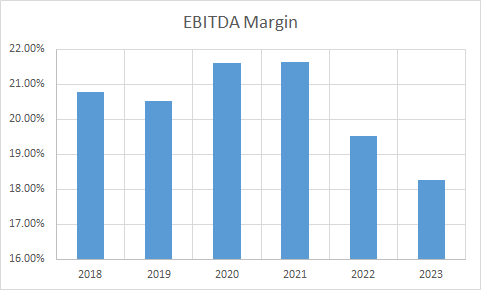

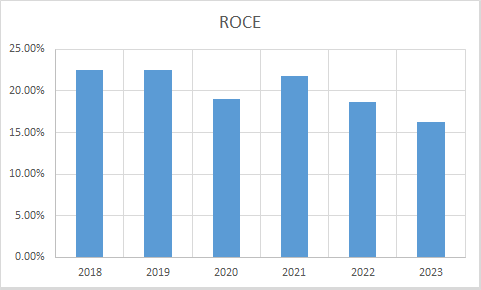

Observations:

- . PAT margins have seen a decline during the period indicating competition in the space.

- Other operating ratios also have seen a decline during the period.

****************************************************

Intrinsic Value of Godrej Consumer Products Ltd.

Before we enter into the calculation of Intrinsic value of Godrej Consumer Products Ltd. we have to make some logical assumptions based on the previous six years financial statements and ongoing yield for 10y Government Of India bonds.

Assumptions:

- Terminal growth rate is assumed to be 0%.

- Weighted Average Cost of Capital(WACC) is assumed to be 12%.

- Free cash flow will be 14% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.14. We assume that this ratio will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free Cash Flow and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Free Cash Flow Growth Model

Intrinsic Value: Rs. 122.04

Stock Entry price with 25% margin of safety: Rs. 91.53

Revenue Growth Model

Intrinsic Value: Rs. 172.50

Stock Entry price with 25% margin of safety: Rs. 129.38

The intrinsic values arrived above are not the same since the Free Cash Flow model considers a pessimistic starting base value of present free cash flow for extrapolation whereas the Revenue Growth model takes the actual point on the extrapolation line for the current year. The average of the above two stock entry prices works out to be Rs. 110.45. When the stock starts trading below this price it becomes attractive for long term investment. This value is valid till the next financial year results are published or some major fundamental change takes place in the company.

****************************************************

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer:

This article is for educational purpose only. Investment in securities market is subject to market risks. Please consult your Financial Advisor before investing.

If You Like This Content 👇👇👇

Click Here To Join Us on Facebook For Free Live Interactive Discussion And Learning

References:

https://www.bseindia.com/stock-share-price/godrej-consumer-products-ltd/godrejcp/532424/financials-annual-reports/

https://www.godrejcp.com/investors/annual-reports

Click Here for Home

FAQs

What is Intrinsic Value?

Ans: When someone invests in an asset, he does so in order to earn money from the business. The investor gets paid over a period of time as long as he is invested in the asset. Now intrinsic value is the present value of all such future cash flows generated by the asset. So logically one should not invest in any asset if the ask price is more than the intrinsic value of the asset.

How is Intrinsic Value of a company calculated?

Ans: For calculating the intrinsic value of a company all its future cash flows are extrapolated based on the past performance of the company, assumptions about the future growth of the company and its terminal value. Once all these are calculated these are brought to the present date based on appropriate discounting rate. The sum of all these gives the intrinsic value of the company. It may be more or less than the market capitalization of the company. If it is more than the market capitalization of the company then the company is said to be undervalued and is a good bet as a long-term investment and vice versa.

How is Intrinsic Value of a share calculated?

Ans: Once intrinsic value of a company is calculated as explained above, it is divided by the total number of outstanding shares of the company. This gives the intrinsic value of a share.

What is Discounted Cash Flow?

Ans: When we have cash flows that are spread over a period of time then Discounted Cash Flow method is used to calculate present value of all such cash flows. The present value depends on the discounting rate used. Usually 10 year Government bond yield rate(risk free rate of return) is used as the discounting rate.