Fundamental Analysis And Intrinsic Value Of Godrej Properties Ltd. (2023-24)

In this article we will try to analyze Godrej Properties Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this fundamental analysis we will try to gain insight into the business activities, financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment. This article is divided in three sections as listed below :-

Section 1: Qualitative Fundamental Analysis comprising of General Introduction, Business overview dwelling into Business Model, Strengths and Weakness, Long Term Sustainability and finally the competitors.

Section 2:Quantitative Fundamental Analysis on Financial Health, Operating Efficiency And Profitability.

Section 3: Calculation Of Intrinsic Value.

General Info

Dated: 26 Nov 23

Company: Godrej Properties Ltd.

CMP: Rs. 2025.10

Market Capitalisation: Rs. 56,305.81 Cr.

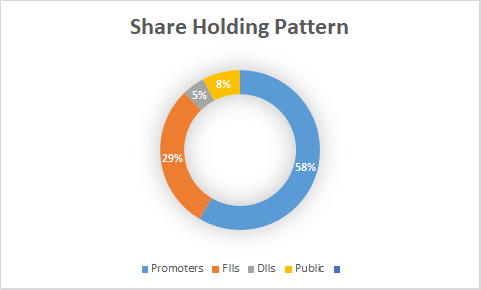

Share Holding Pattern:

Promoters: Pirojsha Godrej, Jamshyd Godrej, Nadir Godrej

Top Five Competitors: DLF, Oberoi Realty, Prestige Estates

Fundamental Analysis Of Godrej Properties Ltd.

General Introduction:

Godrej Properties Limited (GPL) is the real estate development arm of the Godrej Group, which was started in 1897 and is today one of India’s most successful conglomerates. Godrej Properties brings the Godrej Group philosophy of innovation, sustainability, and excellence to the real estate industry. Each Godrej Properties development combines a 126-year legacy of excellence and trust with a commitment to cutting- edge design and technology. Throughout its operations, GPL aims to deliver superior value to all stakeholders through extraordinary and imaginative spaces created out of deep customer focus and insight.

Business Overview:

Between 2014 and 2018, the NBFC market share in developer financing witnessed a significant surge, increasing from 24% to 53%. Developers heavily reliant on NBFC financing faced challenges as deficits in operations required external funding for business continuity. The liquidity crisis that followed led to NBFCs adopting a more cautious approach, reluctant to aggressively fund real estate developers. This shift accelerated consolidation in the sector, creating an environment conducive for well-capitalized developers to expand their portfolios.

Godrej Properties Limited has faced its share of adversities, navigating challenges such as demonetization, the implementation of the Real Estate (Regulation and Development) Act (RERA), Goods and Services Tax (GST) reforms, and the NBFC crisis. These factors, coupled with monetary tightening and funding issues, have created turbulence in cash flows for the company.

Despite the challenges, the recognition of the Godrej brand has played a pivotal role in the company’s ability to raise capital. In response to monetary tightening and funding issues stemming from the NBFC crisis, Godrej Properties Limited adopted strategic financial moves. The company successfully raised capital through private equity placements and Qualified Institutional Placements (QIP).

Notable instances include the preferential allotment in FY 2018-19, where 1,27,65,000 equity shares of Rs. 5/- each were allotted to Gamnat Pte. Ltd. at Rs. 783.50 per share. In March 2021, the company undertook a QIP, allotting 2,58,62,068 shares of Rs. 5/- each at Rs. 1450/- per share. These moves underscore the company’s proactive approach to securing funds and ensuring financial stability.

To further support the real estate sector, the government implemented several measures. Developers received a push with the waiver of notional tax on unsold inventory for two years post-completion of projects. Adjustments in GST rates were made, providing incentives for residential and commercial properties that met specified conditions. The government’s emphasis on affordable housing further shaped the industry landscape.

The company has been able to use the adverse business conditions during COVID-19 to catapult itself into the era of digital transformation, and has embraced digital marketing as a crucial tool for sales and customer outreach. Godrej Properties Limited has utilized digital collaboration tools to interact with potential customers, showcase project brochures, facilitate virtual site tours to drive sales. Emerging technologies such as virtual reality, augmented reality, and AI-powered chatbots have been leveraged to establish personalized services, enhancing the overall customer experience. The company has the brand backing of Godrej and it is operating in a sector which has wide scope for the future however in the present scenario the real estate sector may see further transformation and consolidation before it settles and a clear picture becomes visible.

****************************************************

Financial Ratios

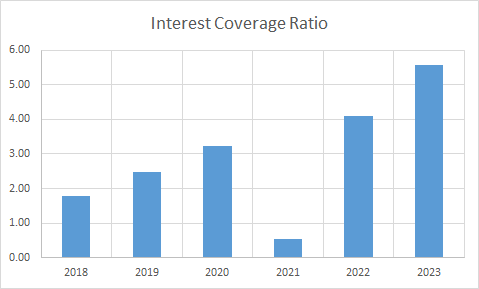

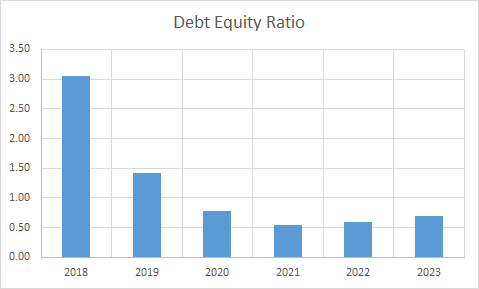

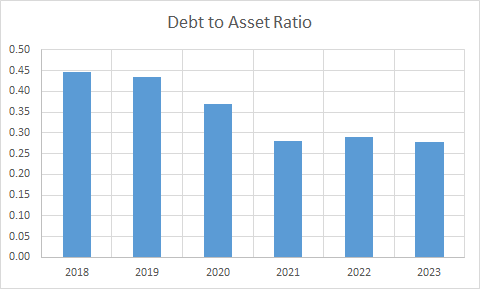

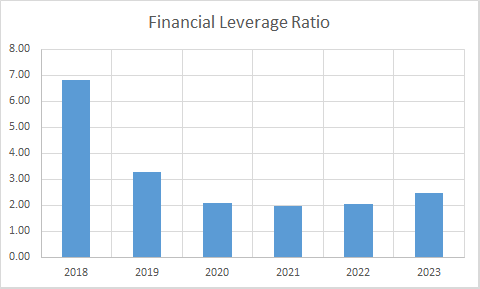

Leverage Ratios

Observations:

- The company has been able to bring down the debt to a great extent during the period.

- Interest coverage ratio has improved as a result of debt reduction.

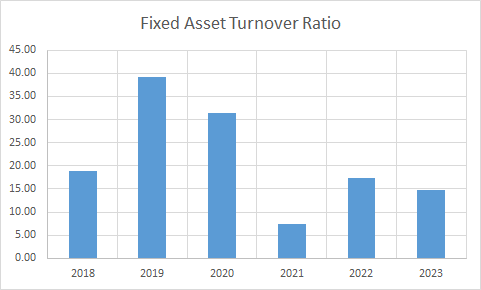

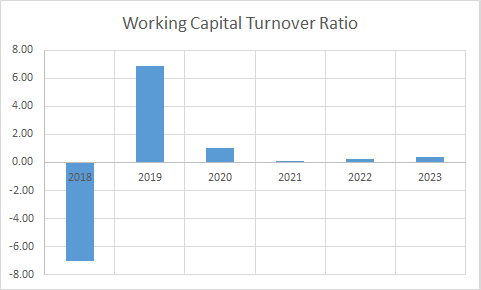

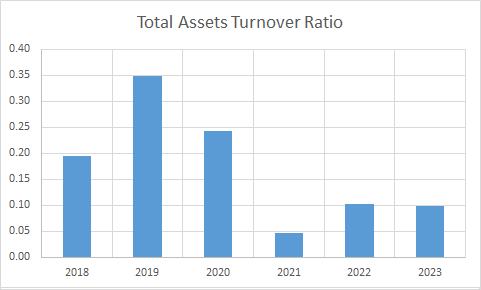

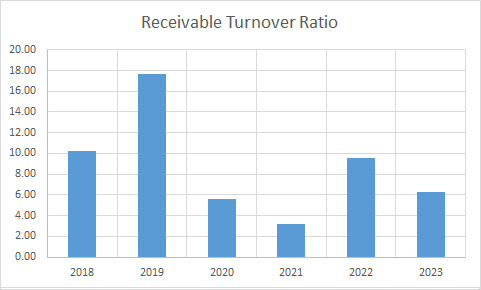

Operating Ratios

Observations:

- Company had negative working capital in 2018 primarily because of advances received against flat bookings.

- There was a decline in advances received against booking but it picked up by 2023, however, there is large increase in Construction Work-in-Progress leading to not so visible change in Working capital turnover ratio.

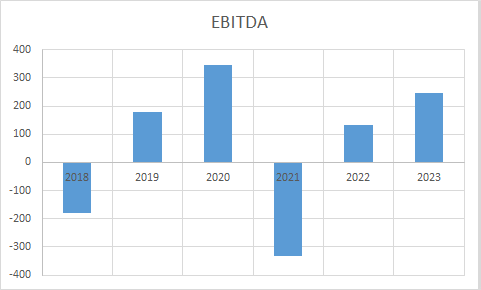

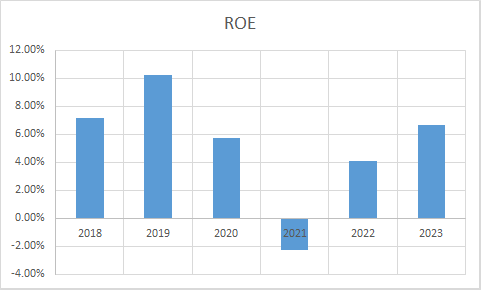

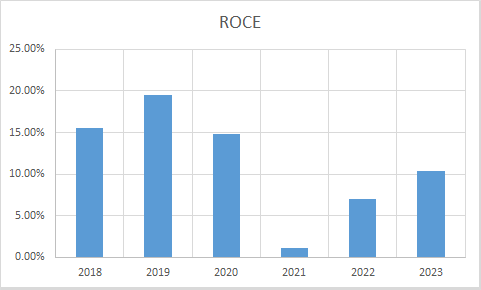

Profitability Ratios

Observations:

- PAT and PAT Margin have improved during the period.

- ROCE has declined due to built up of work in progress inventory post year 2020.

****************************************************

Intrinsic Value of Godrej Properties Ltd.

Before we enter into the calculation of Intrinsic value of Godrej Properties Ltd. we have to make some logical assumptions based on the previous six years financial statements and ongoing yield for 30y Government Of India bonds.

Assumptions:

- Terminal growth rate is assumed to be 0%.

- Weighted Average Cost of Capital(WACC) is assumed to be 12%.

It was not possible to arrive at realistic Intrinsic valuation for the company based on revenue or Free cash Flow to Firm and hence growth rate of shareholder’s equity is taken as a basis for calculation of Intrinsic value of the firm. Since the liquidation value of a firm may be much lower than shareholder’s equity an appropriate margin of safety is employed in the calculation.

Shareholder’s Equity Growth Model

Intrinsic Value: Rs. 319.26

Stock Entry price with 25% margin of safety: Rs. 239.45

When the stock starts trading below Rs 239.45 it becomes attractive for long term investment. This value is valid till the next financial year results are published or some major fundamental change takes place in the company.

****************************************************

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer:

This article is for educational purpose only. Investment in securities market is subject to market risks. Please consult your Financial Advisor before investing.

If You Like This Content 👇👇👇

Click Here To Join Us on Facebook For Free Live Interactive Discussion And Learning

References:

https://www.bseindia.com/stock-share-price/godrej-properties-ltd/godrejprop/533150/financials-annual-reports/

https://www.godrejproperties.com/investor/annual-reports

Click Here for Home

FAQs

What is Intrinsic Value?

Ans: When someone invests in an asset, he does so in order to earn money from the business. The investor gets paid over a period of time as long as he is invested in the asset. Now intrinsic value is the present value of all such future cash flows generated by the asset. So logically one should not invest in any asset if the ask price is more than the intrinsic value of the asset.

How is Intrinsic Value of a company calculated?

Ans: For calculating the intrinsic value of a company all its future cash flows are extrapolated based on the past performance of the company, assumptions about the future growth of the company and its terminal value. Once all these are calculated these are brought to the present date based on appropriate discounting rate. The sum of all these gives the intrinsic value of the company. It may be more or less than the market capitalization of the company. If it is more than the market capitalization of the company then the company is said to be undervalued and is a good bet as a long-term investment and vice versa.

How is Intrinsic Value of a share calculated?

Ans: Once intrinsic value of a company is calculated as explained above, it is divided by the total number of outstanding shares of the company. This gives the intrinsic value of a share.

What is Discounted Cash Flow?

Ans: When we have cash flows that are spread over a period of time then Discounted Cash Flow method is used to calculate present value of all such cash flows. The present value depends on the discounting rate used. Usually 10 year Government bond yield rate(risk free rate of return) is used as the discounting rate.