Fundamental Analysis And Intrinsic Value Of GHCL Ltd. (2023-24)

In this article we will try to analyze GHCL Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this fundamental analysis we will try to gain insight into the business activities, financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment. This article is divided in three sections as listed below :-

Section 1: Qualitative Fundamental Analysis comprising of General Introduction, Business overview dwelling into Business Model, Strengths and Weakness, Long Term Sustainability and finally the competitors.

Section 2:Quantitative Fundamental Analysis on Financial Health, Operating Efficiency And Profitability.

Section 3: Calculation Of Intrinsic Value.

General Introduction

Dated: 03 Jan 24

Company: GHCL Ltd.

CMP: Rs. 602.75

Market Capitalisation: Rs. 5761.43 Cr.

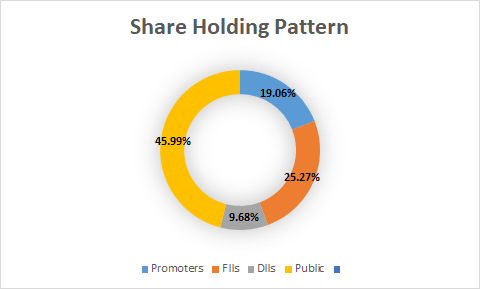

Share Holding Pattern:

Promoters: Sanjay Dalmia, Anurag Dalmia, Neelabh Dalmia

Top Five Competitors: SRF, Tata Chemicals, Deepak Nitrite

Fundamental Analysis Of GHCL Ltd.

General Introduction:

In the realm of Chemicals, GHCL Ltd. engages in the production of Soda Ash (Anhydrous Sodium Carbonate), a pivotal raw material vital to the detergent, glass, ceramics, and Sodium Bicarbonate (baking soda) industries. The company operates a Soda Ash manufacturing plant located in Sutrapada, Gujarat, boasting an installed production capacity of 1.2 million Metric Tonnes Per Annum (MTPA). Currently, GHCL is actively in the process of expanding this capacity by an additional 500 thousand MTPA, with the targeted completion set for the end of 2025.

GHCL’s Soda Ash comes in two distinct grades – light and dense – and is prominently marketed in India under the brand name ‘LION.’ To ensure a consistent supply of raw materials for Soda Ash production, the company also manages lignite mines situated at Khadsaliya in Gujarat’s Bhavnagar district. Additionally, GHCL contributes to the market with approximately 0.12 MTPA of Sodium Bicarbonate, a crucial ingredient in industries such as bakery, pharmaceuticals, fire extinguisher manufacturing, and cleaning agents. In the Consumer Product division, GHCL is involved in the manufacturing and distribution of Edible salt and Industrial grade salt, both marketed under the brand names i-FLO and Sapan. The company’s salt production facility is located in Vedaranyam, Tamil Nadu, with an accompanying refinery in Chennai specifically designed for edible salt manufacturing. This division plays a pivotal role in meeting the salt-related needs of diverse industries and consumers alike.

Business Overview:

GHCL Ltd. is primarily involved in three verticals

- Chemical – Soda Ash under LION brand

- Consumer Products – Edible and industrial grade Salt, spices, blended spices, Honey under iFlow and Sapan brands

- Yarn – Cotton yarn, polyester yarn and home textile products. Spun off as GHCL Textiles Ltd. since 01 Apr 2023

GHCL Ltd. is Bharat’s second largest manufacturer of Soda ash which is a raw material for detergents and glass industry. The soda ash market constitutes of two varieties viz. light grade and dense grade. The light grade soda ash is used in the detergent industry and presently contributes about 55% to the revenue of the company. The dense grade is used in glass manufacturing and contributes about 45% to the revenue of the company. These are the two major industries consuming soda ash in Bharat. Globally 51% of soda ash is used by glass industry. 23% of country’s soda ash requirement is met with imports. GHCL Ltd. meets its raw material requirement through its captive mines of lignite, salt pans and limestone mines giving it a competitive advantage. The major consumers of soda ash are HUL, Ghari Group, Gujarat Guardian, P&G, Patanjali Ayurveda, Fena Group, HNG Group, Gujarat Borosil, Piramal Glass and Philips.

The company also produces sodium bicarbonate as a derivative of soda ash. It finds versatile usage in sectors such as food, food dyes, cleaning application, metal blasting, chemical manufacturing, pharmaceuticals, oral care products, deodorizers and personal care products. Currently GHCL Ltd. caters for 26% domestic requirement of soda ash. 98% of the company’s revenue is generated by soda ash business.

The consumer products division is an offshoot of the chemical division as it is involved in the production of salt which is a raw material used in the production of soda ash. The company owns 3500 acres of salt pans in Vedaranyam, Tamilnadu which caters for the need of soda ash production. In addition to this the company has also started marketing spices, blended spices and honey. The consumer products division contributes less than 2% towards revenue as of now.

The spun-out textile division is involved in the manufacturing of cotton yarn, polyester yarn and home textile products. The textile facility carries out all key operational activities of spinning, weaving, processing and dyeing. GHCL Textiles Ltd. is slowly moving away from being a commodity supplier to developing its own brand. It has launched bedding solutions under two brands ‘Cirkularity’ based on the concept of Reduce, Reuse and Recycle and ‘Meditasi’ as health and wellness bedding collection.

****************************************************

Financial Ratios

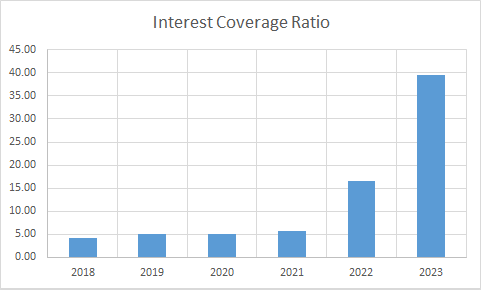

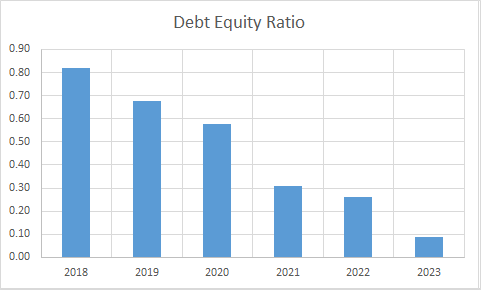

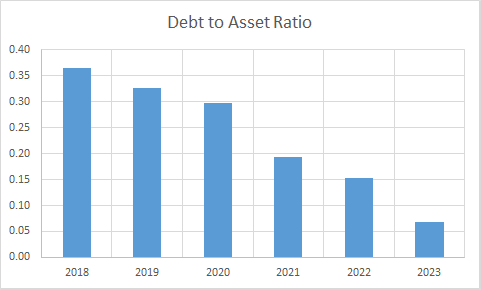

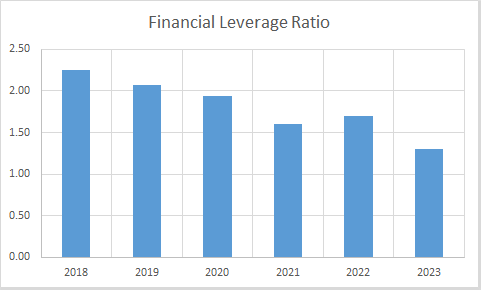

Leverage Ratios

Observations:

- The company has greatly reduced its debt levels and is currently operating with almost no debt.

- The interest coverage ratio has improved during this period.

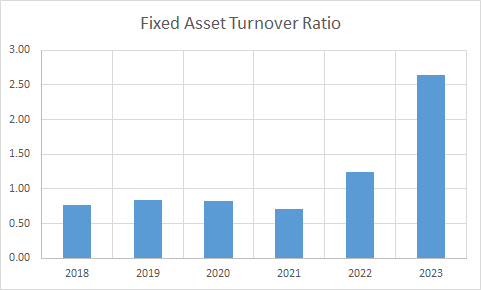

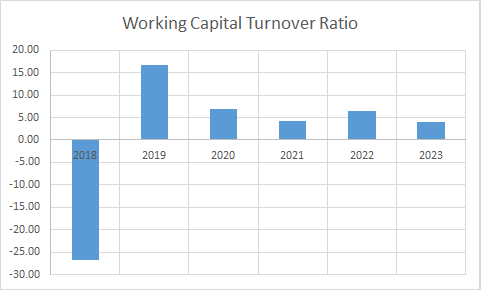

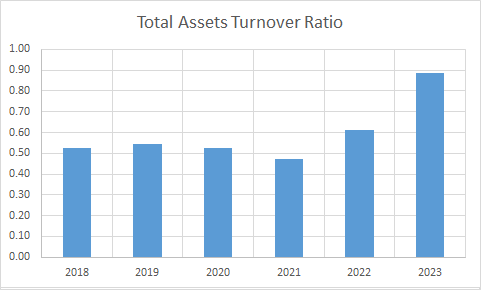

Operating Ratios

Observations:

- Working capital has turned positive during the period.

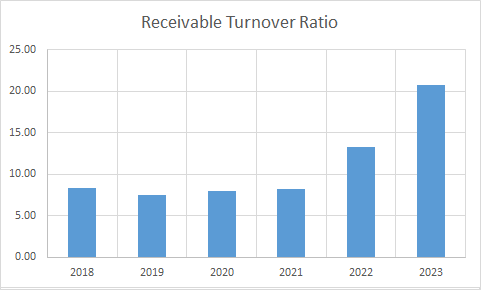

- Receivable turnover has improved.

Profitability Ratios

Observations:

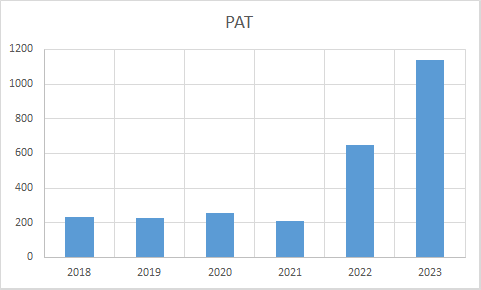

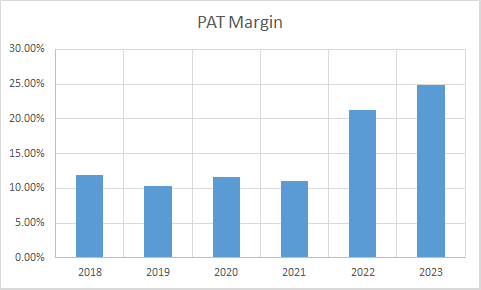

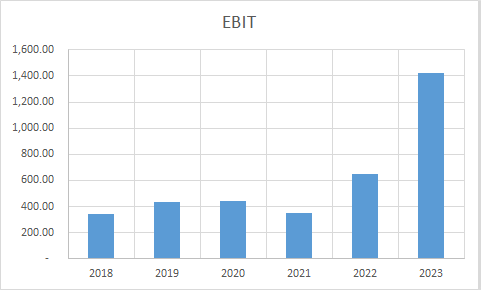

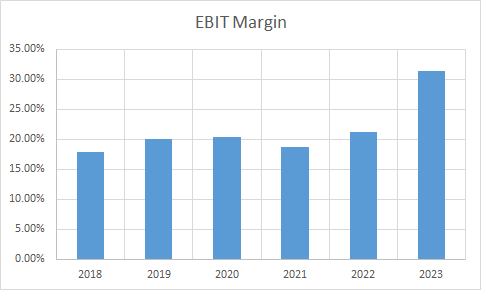

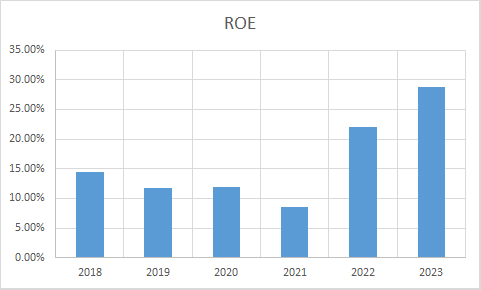

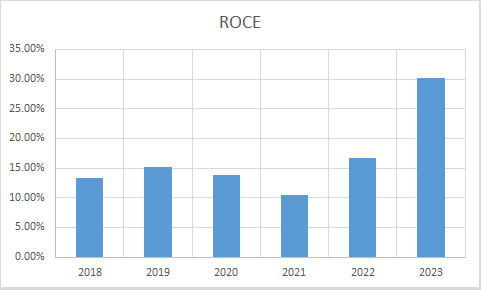

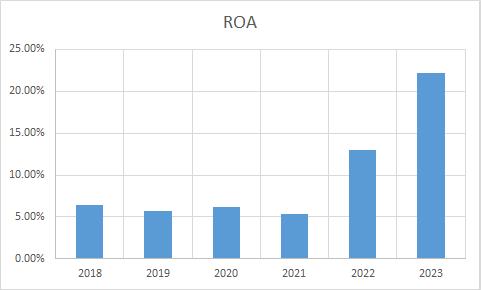

- PAT and PAT margin have shown remarkable improvement. Further, operating profit margin has also improved.

- ROE, ROCE and ROA have all improved during the period.

****************************************************

Intrinsic Value of GHCL Ltd.

Before we enter into the calculation of Intrinsic value of GHCL Ltd. we have to make some logical assumptions based on the previous six years financial statements and ongoing yield for 30y Government Of India bonds.

Assumptions:

- Terminal growth rate is assumed to be 0%.

- Weighted Average Cost of Capital(WACC) is assumed to be 12%.

- Free cash flow will be 16% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.16. We assume that this ratio will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free Cash Flow and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Free Cash Flow Growth Model

Intrinsic Value: Rs. 479.90

Stock Entry price with 25% margin of safety: Rs. 359.93

Revenue Growth Model

Intrinsic Value: Rs. 700.40

Stock Entry price with 25% margin of safety: Rs. 425.31

The intrinsic values arrived above are not the same since the Free Cash Flow model considers a pessimistic starting base value of present free cash flow for extrapolation whereas the Revenue Growth model takes the actual point on the extrapolation line for the current year. The average of the above two stock entry prices works out to be Rs. 442.61. When the stock starts trading below this price it becomes attractive for long term investment. This value is valid till the next financial year results are published or some major fundamental change takes place in the company.

****************************************************

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer:

This article is for educational purpose only. Investment in securities market is subject to market risks. Please consult your Financial Advisor before investing.

If You Like This Content 👇👇👇

Click Here To Join Us on Facebook For Free Live Interactive Discussion And Learning

References:

https://www.bseindia.com/stock-share-price/ghcl-ltd/ghcl/500171/financials-annual-reports/

https://ghcl.co.in/annual-report-integrated-report

Click Here for Home

FAQs

What is Intrinsic Value?

Ans: When someone invests in an asset, he does so in order to earn money from the business. The investor gets paid over a period of time as long as he is invested in the asset. Now intrinsic value is the present value of all such future cash flows generated by the asset. So logically one should not invest in any asset if the ask price is more than the intrinsic value of the asset.

How is Intrinsic Value of a company calculated?

Ans: For calculating the intrinsic value of a company all its future cash flows are extrapolated based on the past performance of the company, assumptions about the future growth of the company and its terminal value. Once all these are calculated these are brought to the present date based on appropriate discounting rate. The sum of all these gives the intrinsic value of the company. It may be more or less than the market capitalization of the company. If it is more than the market capitalization of the company then the company is said to be undervalued and is a good bet as a long-term investment and vice versa.

How is Intrinsic Value of a share calculated?

Ans: Once intrinsic value of a company is calculated as explained above, it is divided by the total number of outstanding shares of the company. This gives the intrinsic value of a share.

What is Discounted Cash Flow?

Ans: When we have cash flows that are spread over a period of time then Discounted Cash Flow method is used to calculate present value of all such cash flows. The present value depends on the discounting rate used. Usually 10 year Government bond yield rate(risk free rate of return) is used as the discounting rate.