Fundamental Analysis And Intrinsic Value of Tata Chemicals Ltd.(2023-24)

In this article we will try to analyze Tata Chemicals Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this fundamental analysis we will try to gain insight into the business activities, financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment. This article is divided in three sections as listed below :-

Section 1: Qualitative Fundamental Analysis comprising of General Introduction, Business overview dwelling into Business Model, Strengths and Weakness, Long Term Sustainability and finally the competitors.

Section 2:Quantitative Fundamental Analysis on Financial Health, Operating Efficiency And Profitability.

Section 3: Calculation Of Intrinsic Value.

General Introduction

Dated: 20 Jan 24

Company: Tata Chemicals Ltd.

CMP: Rs. 1075.70

Market Capitalisation: Rs. 27,404.13 Cr.

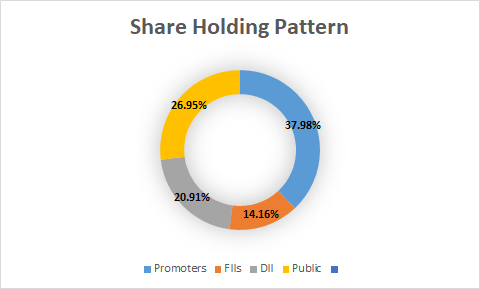

Share Holding Pattern:

Promoters: Tata Sons

Top Five Competitors: Pidilite Industries, SRF, Linde India, Gujarat Fluoroch, Deepak Nitrite, Godrej Industries

Fundamental Analysis Of Tata Chemicals Ltd.

General Introduction:

Tata Chemicals boasts a diversified portfolio that spans various industries, including chemicals, fertilizers, and consumer products. One of its flagship products is soda ash, a crucial ingredient in various industries such as glass, detergents, and chemicals. The company is also a major player in the fertilizer industry, providing essential nutrients to enhance agricultural productivity.

Tata Chemicals has strategically expanded its product offerings to include specialty chemicals, catering to niche markets with high-growth potential. This diversification has not only strengthened its market presence but also positioned the company as an agile and adaptive player in the global chemical landscape.

Business Overview:

A part of the US$ 100 billion Tata Group, Tata Chemicals Limited is a global company with interests in businesses that focus on Basic Chemistry Products, Consumer Products and Specialty Products. Details of product portfolio is as detailed below –

- Basic Chemistry Products

- Soda ash – used in detergents and manufacture of float glass that finds use in construction industry, container glass finding use in bottling industry. It also finds use in the manufacturing of solar glass that is finding accelerating demand as in impetus on renewable sources of energy increases. Additionally, the advent of EVs also has contributed to increased demand of soda ash for manufacturing Lithium Carbonate use in EV batteries.Bicarb – the company manufactures four value added grades of bicarb viz. MediKarb(pharma grade), Sodakarb(food grade), Alkakarb(feed grade) and Speckarb(industrial grade).Cement – finds use in construction industry.Salt – food processing, industrial salt for deicing and other industrial applications.Marine chemicals – Agro chemicals, pesticides, pharma intermediaries and fire retardants etc.

- Crushed refined soda – for manufacturing sodium silicate, animal feed, mining applications, battery manufacturing and affluent treatment.

- Specialty products

- Food – nutritional solutions, wellness products under Tata Nx brand, prebiotic products and stevia based sweeteners made of natural ingredients.Wellness – prebiotics(Fructo-oligo-saccharides), Glacto-oligo-saccharides(GOS), animal feed supplements, FOS based formulations.Agriculture – crop protection solutions, organic manures, plant growth nutrients.Advanced materials – Nano Zinc Oxide finding use in radiation protection products and Highly Dispersable Silica finding use in tyre industry.

- Seeds – genetically modified seeds supplied to the farmers.

The company is the world’s 3rd and 6th largest manufacturer of soda ash and sodium bicarbonate respectively and enjoys strong relationship with customers. It has a unique global supply chain facilitation supply and efficient service at competitive prices to the customers. It has access to vast natural resources in US and Kenya contributing to 2/3rd of company’s manufactured sodium bicarbonate.

The new segment termed nutraceuticals consisting of diet supplements to meet nutritional needs of Indian consumers. In addition, the company also produces high intensity sweeteners to address the growing needs of overweight, obese and diabetic patients. These are marketed under two brands –

- Tata NQ – Nutritional solutions business that offers science backed innovative ingredients and formulations.

- Tata Nx – A range of zero sugar 100% natural sweeteners made from lactose and steviol glycosides.

The mainstay of the company is basic chemistry products while the specialty products is an emerging revenue generator. Revenue breakup of the company is as given below

| 2019 | 2021 | 2023 | |

| Basic Chemistry Products | 68.20% | 74.68% | 80.96% |

| Consumer Products | 15.16% | – | – |

| Specialty Products | 16.63% | 25.32% | 19.04% |

The company has an optimally balanced distribution of revenue across the geographies. Breakup is as given below

| 2019 | 2021 | 2023 | |

| Bharat | 46.92% | 48.26% | 42.98% |

| America | 29.54% | 32.23% | 32.94% |

| Europe | 12.41% | 13.79% | 15.53% |

| Asia(Other than Bharat) | 8.18% | 3.16% | 5.37% |

| Africa | 2.75% | 2.43% | 2.95% |

| Others | 0.19% | 0.14% | 0.21% |

The company has given ample impetus on the necessity of continuing research and development and has set up two world class R&D facilities at Pune and Bengaluru from where products like Highly Dispersable Silica, FOS and Ayaan(fungicide) have emerged.

The company’s business prospects are poised to grow in importance over time, with its innovative applications of soda ash in areas such as solar glass and electric vehicles (EVs). Furthermore, the future is expected to see increased relevance for the company’s products, including health supplements and pharmaceutical intermediaries. This demonstrates the company’s ability to adapt and provides a clear vision for its future business activities.

****************************************************

Financial Ratios

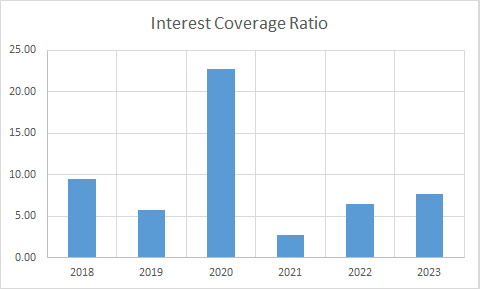

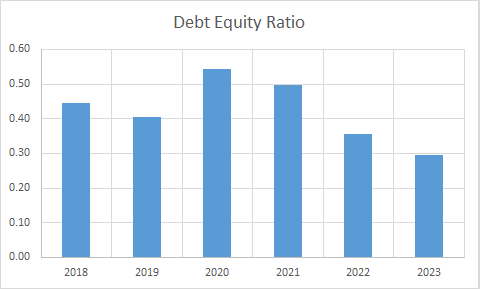

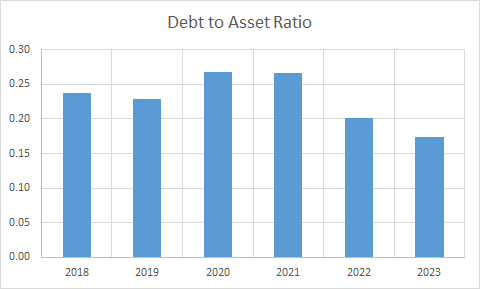

Leverage Ratios

Observations:

- The company has managed to reduce its debt levels during this period.

- It is maintaining a decent interest coverage ratio.

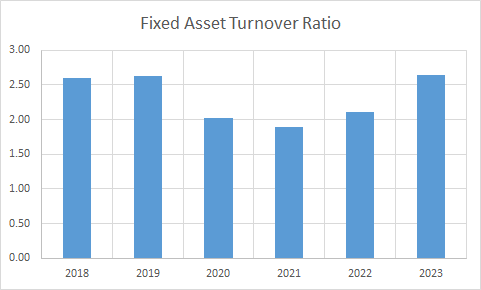

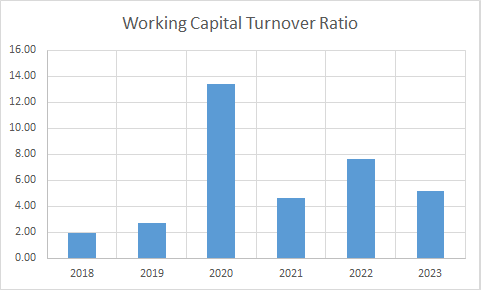

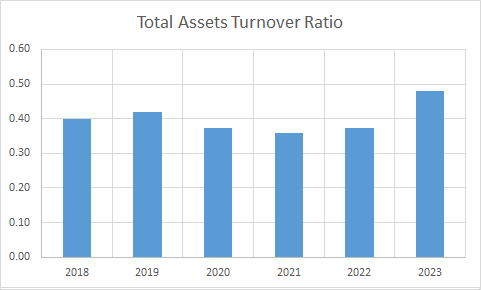

Operating Ratios

Observations:

- The company is maintaining a positive working capital turnover ratio and it has improved during the period.

- The receivable turnover ratio has remained stable during the period when revenue has seen an improvement.

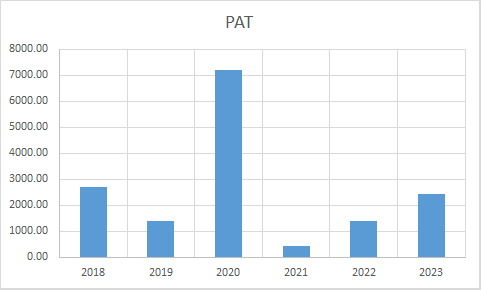

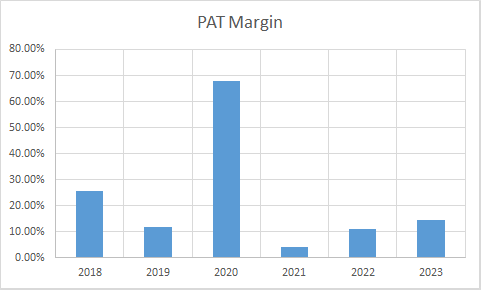

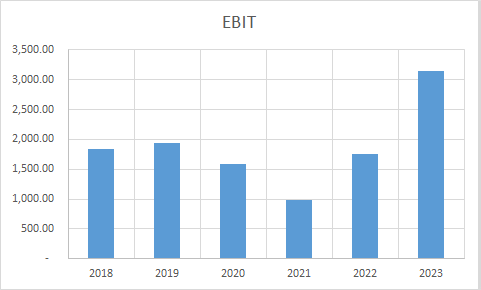

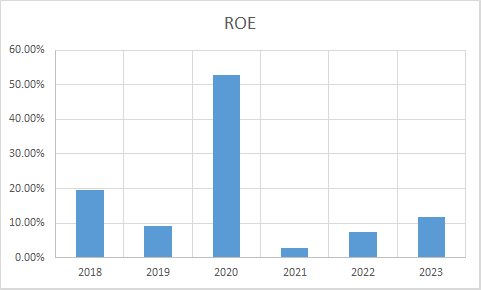

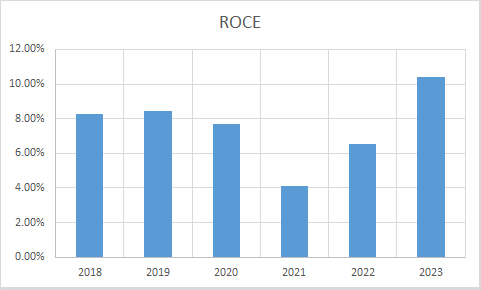

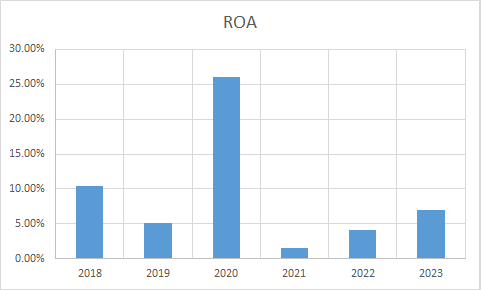

Profitability Ratios

Observations:

- PAT and PAT margins have not yet regained pre-Covid levels. Year 2020 saw unusual spike in profits, however, this was due to exceptional gains of Rs. 6128.08 Crores from discontinued operations. This was due to de-merger of Consumer products business unit of the company and merger of the same with Tata Consumer Products Limited as sanctioned by NCLT Kolkata.

****************************************************

Intrinsic Value of Tata Chemicals Ltd.

Before we enter into the calculation of Intrinsic value of Tata Chemicals Ltd. we have to make some logical assumptions based on the previous six years financial statements and ongoing yield for 30y Government Of India bonds.

Assumptions:

- Terminal growth rate is assumed to be 0%.

- Weighted Average Cost of Capital(WACC) is assumed to be 12%.

- Free cash flow will be 11% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.11. We assume that this ratio will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free Cash Flow and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Free Cash Flow Growth Model

Intrinsic Value: Rs. 433.60

Stock Entry price with 25% margin of safety: Rs. 325.20

Revenue Growth Model

Intrinsic Value: Rs. 645.30

Stock Entry price with 25% margin of safety: Rs. 483.98

The intrinsic values arrived above are not the same since the Free Cash Flow model considers a pessimistic starting base value of present free cash flow for extrapolation whereas the Revenue Growth model takes the actual point on the extrapolation line for the current year. The average of the above two stock entry prices works out to be Rs. 404.59. When the stock starts trading below this price it becomes attractive for long term investment. This value is valid till the next financial year results are published or some major fundamental change takes place in the company.

****************************************************

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer:

This article is for educational purpose only. Investment in securities market is subject to market risks. Please consult your Financial Advisor before investing.

If You Like This Content

Click Here To Join Us on Facebook For Free Live Interactive Discussion And Learning

References:

BSE – Tata Chemicals Ltd. – Annual Reports

Tata Chemicals Ltd. – Investors – Annual Reports

Click Here for Home

FAQs

What is Intrinsic Value?

Ans: When someone invests in an asset, he does so in order to earn money from the business. The investor gets paid over a period of time as long as he is invested in the asset. Now intrinsic value is the present value of all such future cash flows generated by the asset. So logically one should not invest in any asset if the ask price is more than the intrinsic value of the asset.

How is Intrinsic Value of a company calculated?

Ans: For calculating the intrinsic value of a company all its future cash flows are extrapolated based on the past performance of the company, assumptions about the future growth of the company and its terminal value. Once all these are calculated these are brought to the present date based on appropriate discounting rate. The sum of all these gives the intrinsic value of the company. It may be more or less than the market capitalization of the company. If it is more than the market capitalization of the company then the company is said to be undervalued and is a good bet as a long-term investment and vice versa.

How is Intrinsic Value of a share calculated?

Ans: Once intrinsic value of a company is calculated as explained above, it is divided by the total number of outstanding shares of the company. This gives the intrinsic value of a share.

What is Discounted Cash Flow?

Ans: When we have cash flows that are spread over a period of time then Discounted Cash Flow method is used to calculate present value of all such cash flows. The present value depends on the discounting rate used. Usually 10 year Government bond yield rate(risk free rate of return) is used as the discounting rate.