Fundamental Analysis and Intrinsic Value of Indian Oil Corporation Ltd.(2024-25)

In this article we will try to analyze Indian Oil Corporation Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this fundamental analysis we will try to gain insight into the business activities, financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment. This article is divided in three sections as listed below :-

Section 1: Qualitative Fundamental Analysis comprising of General Introduction, Business overview dwelling into Business Model, Strengths and Weakness, Long Term Sustainability and finally the competitors.

Section 2: Quantitative Fundamental Analysis on Financial Health, Operating Efficiency And Profitability.

Section 3: Calculation Of Intrinsic Value.

General Introduction

Dated: 02 Jun 24

Company: Indian Oil Corporation Ltd.

CMP: Rs.162.40

Market Capitalisation: Rs. 2,29,328.91 Cr.

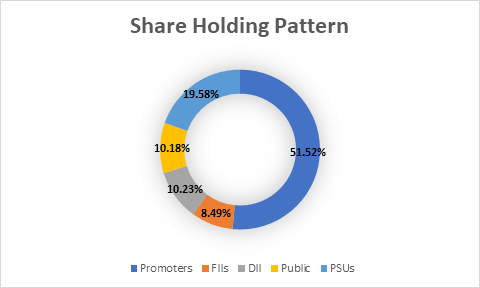

Share Holding Pattern:

Promoters: Government of India

Peers: Reliance Industries, HPCL, MRPL, ONGC

Fundamental Analysis Of Indian Oil Corporation Ltd.

General Introduction:

Indian Oil Ltd. is India’s highest ranked energy PSU, and finds an enviable place in Fortune-500 list of 2023. It supplies petroleum fuels to every nook and corner of the country through its network of over 60,000 plus outlets/ customer touch points. The company boasts a pipeline network of 17,564 kms. In addition to supplying fuel like petrol and diesel and its variants the company also provides services like EV charging infrastructure and Way Side Amenities along National Highways. The company’s R&D facility at Faridabad is equipped with cutting edge equipment to undertake path breaking research work in the field of downstream petroleum products.

************************************************

For complete article including Qualitative Fundamental Analysis (Business Overview – A sneak peek into future), Quantitative Fundamental Analysis and Intrinsic Value calculation please subscribe to Premium Membership. To know more about Premium Membership Click Here.

*************************************************

Author

Jibu Dharmapalan

SEBI Registered Research Analyst

Registration No. INH000014678

GSTIN: 32AHVPD3247L2Z3

Click Here To Contact on – Whatsapp or Telegram

Check Intermediary on SEBI Website

If You Like This Content 👇👇👇

Click Here To Join Us on Facebook For Free Live Interactive Discussion And Learning

References:

BSE India – IOC Ltd. Annual Reports

IOC Ltd. – Investors – Annual Reports

Click Here for Home

Disclaimers

- Investment in securities market is subject to market risks. Please read all the related documents carefully before investing.

- Registration granted by SEBI and certification from NISM in no way guarantee the performance of the intermediary or provides any assurance of returns to investors.

- Past performance is not indicative of future results.

- I am SEBI Registered “Research Analyst”.

Disclosures

Standard Disclosure

1. Number of disputes/ resolved in last one year – 0/0

2. Terms and conditions on which the research report is offered – Contact on Whatsapp, Click Here

3. Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company and the nature of such financial interest. – No

4. Whether the research analyst or research entity or its associates or relatives, have actual/beneficial ownership of one percent or more securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance – No

5. Whether the research analyst or research entity or its associates or relatives, have actual/beneficial ownership of one percent or more securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance. – No

Disclosure With Regards to Compensation

6. Whether the research analyst has received any compensation from the subject company in the past twelve months. – No

7. Whether the research analyst has managed or co-managed public offering of securities for the subject company in the past twelve months. – No

8. Whether the research analyst has received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months. – No

9. Whether the research analyst has received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months. – No

10. Whether the research analyst has received any compensation or other benefits from the subject company or third party in connection with the research report. – No

Disclosures With Regards To Association With The Company

11. Whether the research analyst has served as an officer, director or employee of the subject company – No

12. Has the Research Analyst acted as a manager or co-manager at any time falling within a period of forty days immediately following the day on which the securities are priced if the offering is an initial public offering. – No

13. Has the Research Analyst acted as a manager or co-manager at any time falling within a period of ten days immediately following the day on which the securities are priced if the offering is a further public offering. – No

14. Provided that research analyst is publishing or distributing research report or research analysis or making public appearance within such forty day and ten-day periods, has he received prior written approval of legal or compliance personnel as specified in the internal policies and procedures? – NA

15. A research entity who has agreed to participate or is participating as an underwriter of an issuer’s initial public offering shall not publish or distribute a research report or make public appearance regarding that issuer before expiry of twenty-five days from the date of the offering. Does the Research Analyst comply with this regulation? – Yes

16. Has the Research analyst acted as a manager or co-manager of public offering of securities of the company? – No

17. If the answer to point no. 16 is ‘yes’ then has the Research Analyst entered into expiration/waiver/termination of a lock-up agreement or any other agreement with the subject company that restricts or prohibits the sale of securities held by the subject company after the completion of public offering of securities? This includes the period fifteen days prior and fifteen days after the contractual period as per the agreement. – NA

18. Provided that research analyst is publishing or distributing research report or research analysis or making public appearance regarding that company within such fifteen days, has he obtained prior written approval of legal or compliance personnel as specified in the internal policies and procedures. – NA

19. Whether the research analyst has been engaged in market making activity for the subject company – No

FAQs

What is Intrinsic Value?

Ans: When someone invests in an asset, he does so in order to earn money from the business. The investor gets paid over a period of time as long as he is invested in the asset. Now intrinsic value is the present value of all such future cash flows generated by the asset. So logically one should not invest in any asset if the ask price is more than the intrinsic value of the asset.

How is Intrinsic Value of a company calculated?

Ans: For calculating the intrinsic value of a company all its future cash flows are extrapolated based on the past performance of the company, assumptions about the future growth of the company and its terminal value. Once all these are calculated these are brought to the present date based on appropriate discounting rate. The sum of all these gives the intrinsic value of the company. It may be more or less than the market capitalization of the company. If it is more than the market capitalization of the company then the company is said to be undervalued and is a good bet as a long-term investment and vice versa.

How is Intrinsic Value of a share calculated?

Ans: Once intrinsic value of a company is calculated as explained above, it is divided by the total number of outstanding shares of the company. This gives the intrinsic value of a share.

What is Discounted Cash Flow?

Ans: When we have cash flows that are spread over a period of time then Discounted Cash Flow method is used to calculate present value of all such cash flows. The present value depends on the discounting rate used. Usually 30 year Government bond yield rate(risk free rate of return) is used as the discounting rate.