Fundamental Analysis And Intrinsic Value of Himadri Speciality Chemicals Ltd.

Dated: 31 May 23

Company: Himadri Speciality Chemicals Ltd.

CMP: Rs. 127.60

Introduction

Himadri Speciality Chemicals Ltd. was established in 1987 and operates in the specialty chemicals segment with Carbon black as its core product which finds its application in rubber, tyre and pigment industries. Other main products are Coal tar pitch crucial for aluminum and graphite electrode industries and naphthalene derivatives that are vital for pharmaceuticals, agrochemicals and dyes.

In this article we will try to analyze Himadri Speciality Chemicals Ltd. based on previous six years of financial statements viz Balance sheet, Profit and Loss statement and Cash flow statement. With this analysis we will try to gain insight into the financial health, operating efficiency and profitability of the company and finally try to derive the intrinsic value of the stock using Discounted Cash Flow method and the price at which the stock becomes attractive for long term investment.

Note: Here we are carrying out only the quantitative fundamental analysis of the company as the qualitative analysis is more subjective and individual views may vary vastly.

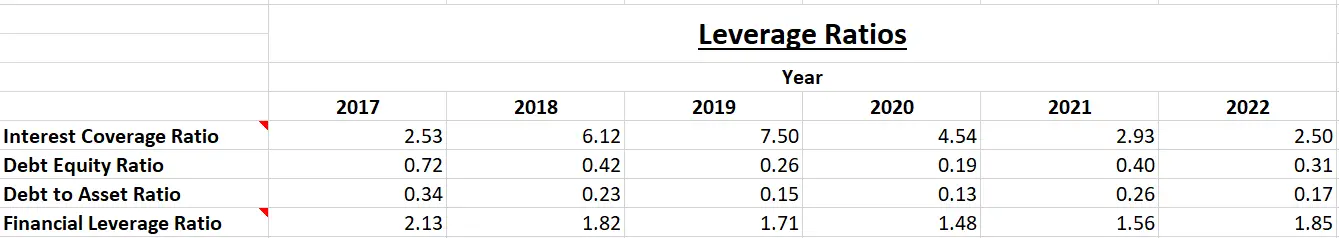

Leverage Ratios

Observations:

- The company has managed to reduce its debt during this period.

- Interest coverage ratio has not shown an improvement despite decrease in debt levels since PAT has not improved in line with expectation.

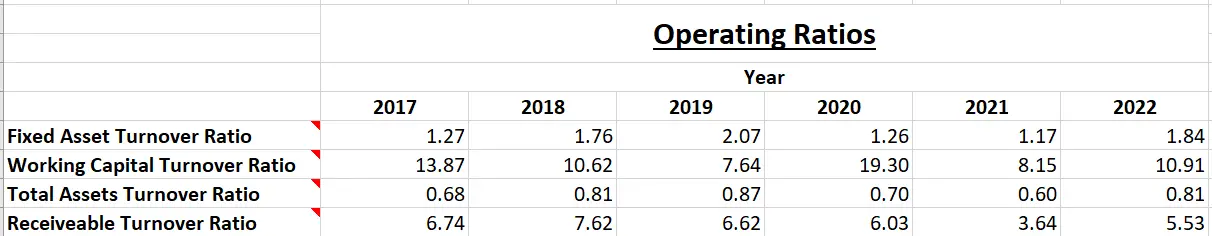

Operating Ratios

Observations:

- Company is inching closer to achieving working capital utilisation to pre covid levels.

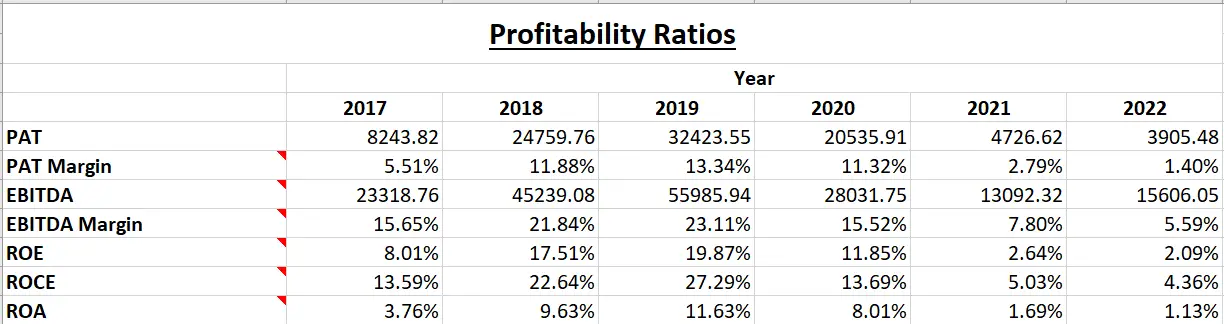

Profitability Ratios

Observations:

- PAT and EBITDA along with the respective margins have dwindled post COVID. This indicates tough competition in the field.

- PAT has reduced despite 65% increase in revenue over previous year. On further checking the financial documents we discover that this is due to a more than 100% jump in cost of materials consumed during the year as compared to previous year.

Intrinsic Value

Assumptions:

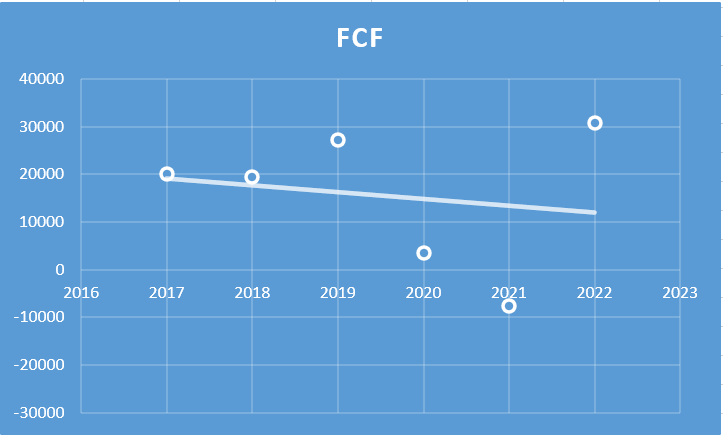

- The change in Free Cash Flow is assumed to be Rs. -729.49 lakhs per year for the first five years and then Rs -364.75 lakhs per year from sixth to tenth year. This rate of change is projected based on the past figures of Free Cash Flow (refer to figure below). In the past Free Cash Flow has changed at the rate of Rs. -1458.99 lakhs per year, however, with a conservative outlook we have taken 50% of that figure for the first five years and 25% of that for the next five years.

- Terminal growth rate is assumed to be 0%.

- Discount rate is assumed to be 12%.

- Increase in Revenue is assumed to be Rs.6731.99 lakhs per year for the first five years and then Rs 3366.00 lakhs per year for the next five years. This growth rate is based on analysis of previous year’s revenues (refer to figure below). In the past revenue has increased at the rate of Rs. 13463.99 lakhs per year, however, with a conservative outlook we have taken 50% of that figure for the first five years and 25% of that for the next five years.

- Free cash flow will be 7% of revenues in future. The FCF/Revenue ratio for the period under consideration has an average of 0.07. Here we assume that the same average will hold good for future.

Based on the above assumptions we have arrived at two levels as intrinsic value of the firm. One is based on extrapolation of Free cash flows and the other is based on Free cash flows derived from extrapolated values of revenues. Both the methods only differ in how the input values are derived; in both the cases the present value is arrived at using Discounted Cash Flow Method.

Free Cash Flow Growth Model

Intrinsic Value: Rs. 13.90

Stock Entry price with 25% margin of safety: Rs.10.43

Revenue Growth Model

Intrinsic Value: Rs.37.32

Stock Entry price with 25% margin of safety: Rs.27.99

The average of the above two stock entry prices works out to be Rs. 19.21. When the stock starts trading below this price it becomes attractive for long term investment.

Author

Jibu Dharmapalan

Fundamental Analyst

Disclaimer: This is not a stock advise. Investors must use their due diligence before buy/selling any stocks.

References:

https://www.himadri.com/performance

More about the Company:

Board Of Directors

| Mr. Shyam Sundar Chaudhary | Director |

| Mr. Bankey Lal Chaudhary | Promoter, Managing Director |

| Mr. Vijay Kumar Chaudhary | Director |

| Mr. Anurag Chaudhary | Promoter, Non-Executive Director |

| Mr. Amit Chaudhary | Director |

| Mr. Tushar Chaudhary | Promoter, Non-Executive Director |

| Mr. Hardip Singh Mann | Director |

| Mr. Shakti Kumar Banerjee | Director |

| Mr. Santimony Dey | Director |

| Mr Santosh Kumar Agrawal | Independent Director |

| Ms. Sucharita Basu De | Independent Director |

| Mr. Girish Paman Vanvari | Independent Director |

| Mr. Gopal Ajay Malpani | Director |

Click Here to go to Home Page

Click Here to go to Previous Post

Click Here to go to Next Post